Last Updated on 27/10/2025 by Carl-Peter Lehmann

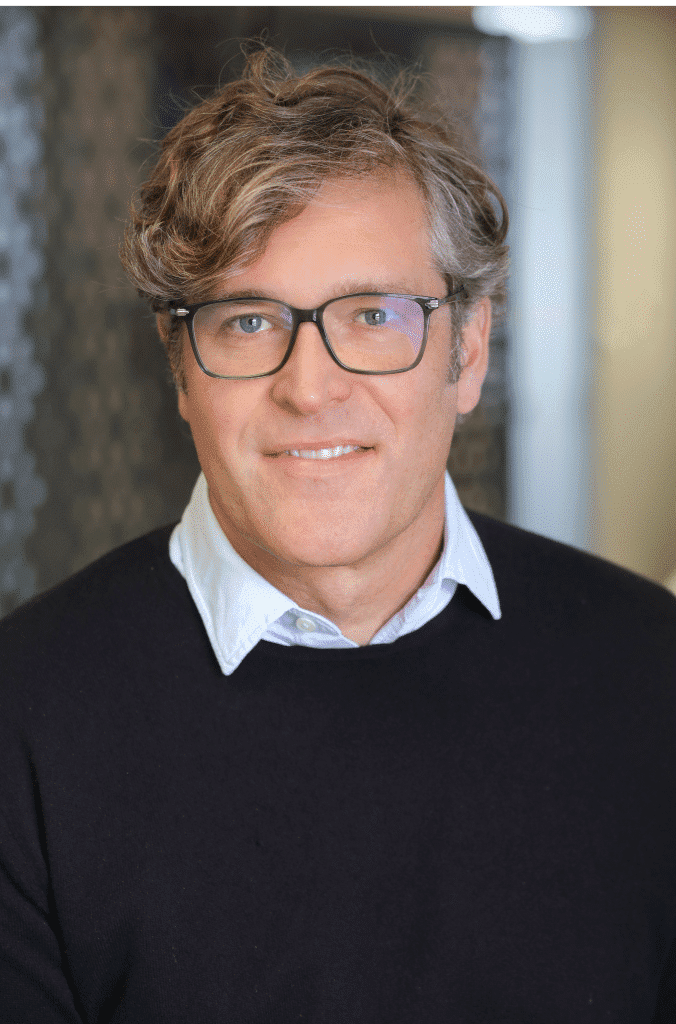

Interview with the manager of the best performing balanced fund in South Africa: Just a few steps from the Kommetjie surf that inspired his firm’s name, we sat down with David Hansford … the single-minded manager behind one of South Africa’s best-performing balanced funds … to unpack how a boutique born from a Reg 28 pivot grew from R35 million to R650 million. In a world of committees and benchmark-hugging, Hansford runs near the equity and offshore limits for accumulators, owns capital-light compounders, and actually holds them long enough to matter. What follows is a candid conversation about philosophy, process, and the trade-offs behind outperformance – from Shopify and Cloudflare to succession plans and why SA’s opportunity set still can’t match the world’s.

Interview conducted by Carl-Peter Lehmann with Steven Hall.

The Origin Story: From Reg 28 Pivot to Boutique Outperformance

How a boutique manager turned R35m into R650m — and why “buy great companies and hold on” still works.

When balanced funds transitioned from investors self-managing Reg 28 exposure to trustees carrying that responsibility, a small spark lit the fuse for Long Beach. “In 2013 there was a request to have a balanced fund for the Prescient Provident Fund,” says David Hansford, Portfolio Manager at Long Beach. “That’s where the managed fund started.”

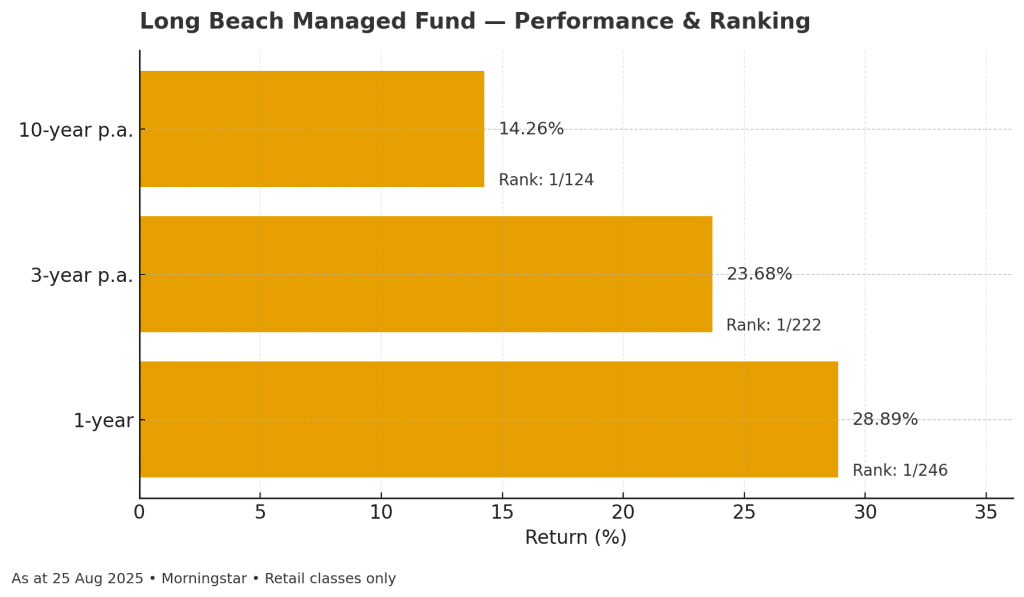

Two years later, Hansford bought the FSP from Prescient Securities. Back then, both Long Beach funds together managed R35 million. Today, they sit at roughly R650 million — still boutique in size, but with performance that’s punched well above its weight in recent years.

“My investment philosophy, if you want it in a few words, is:buy great companies and hold on.” — David Hansford

Further Reading: Balanced funds for retirement annuity investment and all the top performers

One mind, one mandate

Naming an asset manager is harder than it looks. Hansford lives in Kommetjie, a short walk from the surf at Long Beach. “Another fund manager once told me he named the firm after his street. I thought, well, I live next to Long Beach — that’s a pretty good name.” It’s hard to argue with a brand that’s as authentic as it is memorable.

Authenticity extends into the structure too. Long Beach runs lean:

Hansford is key individual and portfolio manager for both funds.

1. Prescient handles the Manco and fund administration; Moonstone manages compliance.

2. A consulting accountant oversees financials, and Alisa Mitlitska recently joined to support marketing.

3. And the succession question? “If I’m permanently incapacitated, the funds roll into Prescient Fund Services, and a large institutional manager. We set it up so clients avoid any liquidity risk — even if everyone wanted out at once, it would be handled inside a much bigger pool.

One decision-maker, one invesment philosophy

Plenty of funds are steered by committees. Long Beach is not. “Because it’s both my business and I manage the funds, I’ve consistently tried to take the best decisions for investors, not the business,” Hansford says. In larger firms, especially during rough patches, “there can be a tendency to manage the fund for business purposes rather than investment purposes — hugging benchmarks, taking less risk than the mandate allows. I try to do the opposite: put clients first.”

That shows up in clear positioning. In the balanced fund:

1. Offshore exposure sits near the Reg 28 max (45%).

2. Equity exposure is typically in the low-to-mid 70s%, toward the top of the limit.

3. The mandate is for accumulators, not drawdown clients: accept reasonable volatility to maximize growth.

“We unashamedly say we’re looking to maximize growth in the balanced fund for accumulating investors.” — Hansford

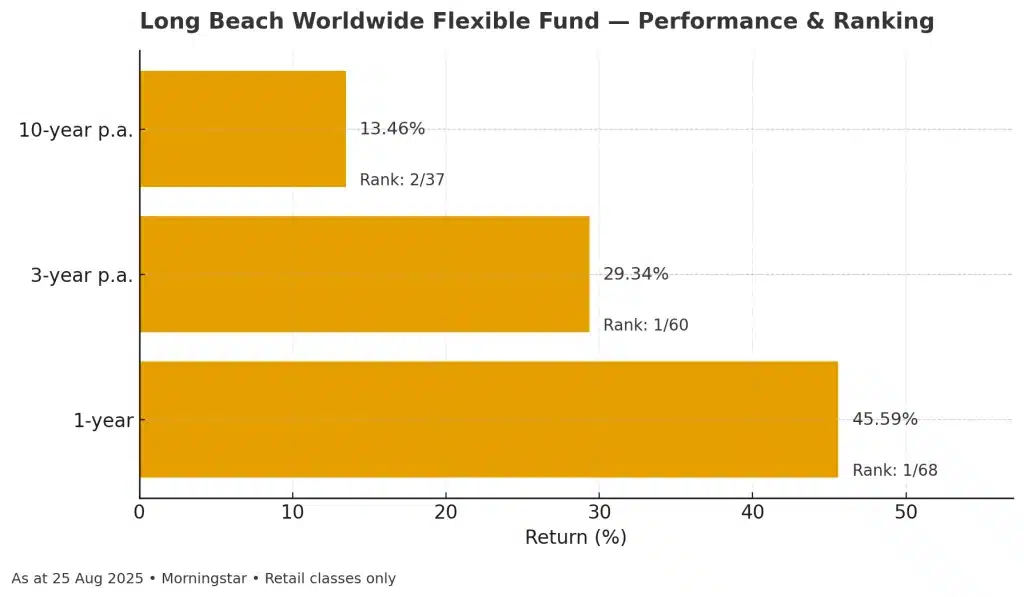

Long Beach Managed Prescient Fund performance and ranking

The “secret sauce”: buy great, then actually hold

Everything pivots on a simple idea: own businesses with exceptional economics and let compounding work.

Hansford’s checklist reads like a quality investor’s cheat sheet:

- Capital-light models

- Large addressable markets

- Recurring, small-ticket revenue

- Prefer B2C over B2B (stickier customer relationships)

He’s allergic to one-number valuation takes. “People get hung up on the current P/E. But good companies often look expensive and bad companies often look cheap. I think in valuation bands, not checkpoints.”

The bigger lesson? Don’t sell winners too early.

“One of my biggest mistakes over the years was selling too early. If I have a good idea, I like to let it run. I’ll sell when something gets egregiously expensive — not just because it’s 10–20% above my estimate of fair value.”

Case studies: Shopify, Cloudflare & the cost of conviction

Two of Long Beach’s long-held names — Shopify and Cloudflare — neatly illustrate the philosophy.

1. Shopify roared in 2020/21, then stumbled as the market wrote it off as a “COVID winner.” Under the hood, revenue growth re-accelerated to ~31%, the product suite moved upmarket (signing enterprise clients like Nestlé and Starbucks), and new lines (B2B) opened additional runways. The switching costs are real: once a merchant embeds operations into Shopify’s stack, “they’re unlikely to switch out.”

2. Cloudflare sits in that capital-light, recurring-revenue sweet spot powering the modern internet. Both stocks added to volatility — juicing returns in 2021 and biting in 2022 — but that’s the price of owning long-duration growth.

Hansford’s research approach is surprisingly human in an age of quant dashboards: read widely and use the products. “Peter Lynch used to talk about going to the mall for ideas. A common theme in our portfolios is that you and I probably interact with a lot of the companies we own.”

Consider Reading: Our interview with Granate Asset Management, another top South African boutique asset manager

Why max offshore?

Simple: opportunity set. “South Africa’s economy has productivity constraints and is in a low-growth trap absent structural reform,” says Hansford. “There may be good trading opportunities locally, but sustained long-term growth is easier to find outside SA.” Hence the balanced fund’s offshore stance near the cap, whenever regulations allow.

Isn’t that more volatile? Yes — by design. The fund states the objective upfront: it’s built for accumulators who want growth, not retirees drawing an income who require a smoother ride.

Further Reading: Investing offshore as a South African including some of the top performing offshore funds

long beach worldwide flexible prescient fund ranking and performance

The boutique question: can one person really run it?

It comes up a lot. Hansford shrugs. “Sixteen years later, I’ve probably proven that I can.” The lean setup reduces bureaucracy and speeds decisions. The succession agreement provides the safety net. And the track record (with both good and bad years) shows a consistent process rather than rear-view-mirror style drift.

“Because it’s my business and I run the money, I can resist the pressure to manage for marketing.” — Hansford

Henceforward view: why this approach resonates

At Henceforward we’ve long argued that clarity beats committee. What resonates here isn’t a clever factor model; it’s the discipline to own great businesses, run close to the mandate where it makes sense, and be honest that volatility is the toll for higher long-term returns.

And yes – we often get super frustrated sitting through asset-manager presentations that all read from the same script: “the market (or X/Y/Z sector) is cheap/expensive; mean reversion will bail us out; we’re early, not wrong.” That story tends to double as a multi-year excuse for underperformance. Mean reversion can be a tailwind, but it’s not a strategy and it’s rarely a catalyst. We prefer managers who anchor on business economics, competitive advantage, reinvestment runways, and who actually let winners run – because performance is earned in the portfolio, not the pitchbook.

P.S. None of this is financial advice; whether this style suits you depends on your goals, timeframe, and risk tolerance. If you’re in the accumulation phase and comfortable with a growth-oriented balanced strategy, it’s a playbook worth understanding.

Valuation is a starting point, not an edge; mean reversion is hope, not a catalyst. Give us durable unit economics and the courage to hold winners every time.

Further Reading: How Henceforward Works With Clients on Our Unique Flat Fee Advice Model

Key takeaways

1. One mind, clear mandate: A single decision-maker running close to Reg 28 limits for growth.

2. Quality over “cheap”: Focus on economics, not just low P/Es; think in valuation bands.

3. Let winners run: Avoid the classic mistake of selling too early.

4. Use what you own: Hands-on research and real-world interaction with products.

5. Max offshore for opportunity: The global market offers broader, deeper growth runways than SA.

Interesting Read: How much money do you need to retire in South Africa in 2025?

FAQ on long beach capital and investing

-

1. What is Regulation 28 and why does it matter?

Reg 28 caps asset class and offshore exposure for SA retirement products to manage risk. Long Beach runs near the limits to maximise growth for accumulators.

-

2. Who should consider a growth-tilted balanced fund?

Investors still accumulating (not drawing an income) who can tolerate volatility for higher expected long-term returns

-

3. Why favour B2C and capital-light businesses?

They often have stickier customers, high margins, and scalable economics—powerful for compounding.

-

4. Isn’t a high P/E always risky?

Not necessarily. For quality compounders, valuation should be viewed in bands with growth, margins, and reinvestment runways in mind.

-

5. How is succession risk handled at long beach?

A pre-agreed roll-up into Prescient Fund Services and a large institutional manager fund mitigates liquidity and operational risk.

Carl-peter lehmann

Carl-Peter “CP” Lehmann, CFP®, is a Director at Henceforward, a Cape Town–based wealth and financial-planning boutique. With 20+ years in global markets—especially offshore investing—CP’s passion is helping clients and everyday investors cut through industry noise, find under-the-radar gems, and turn fund-manager conversations into plain-English insights you can use. He blends data and narrative to stress-test ideas, separate luck from skill, and build goal-aligned portfolios. When he’s not dissecting spreadsheets or interviewing managers, he’s usually on a trail somewhere in the Cape.