Article updated 25 January 2024. Are you considering a retirement annuity (RA) but unsure about its advantages? In this article, we’ll explore the numerous benefits of a retirement annuity, aiming to provide you with valuable information to make informed decisions about your financial future. Retirement annuities offer tax advantages and serve as an investment product designed to secure your financial security during retirement. But they do also have their downsides! Let’s delve into the key aspects and consider their pros and cons.

Table of Contents

Understanding the Aims of a Retirement Annuity

A retirement annuity serves as a valuable tool to help you achieve financial security in your retirement years. It acts as an investment product that provides tax advantages, incentivizing you to save for your future. The government encourages personal retirement savings to reduce dependence on state-funded support during old age. If you belong to an employer-sponsored fund, such as a pension or provident fund, a retirement annuity can supplement your existing retirement savings. For those who are self-employed or not part of an employer fund, a retirement annuity can become your primary investment for retirement—a personal pension plan.

Decoding How Retirement Annuities Work

When you opt for a retirement annuity, you can make regular contributions or lump sum payments. Additionally, you have the freedom to choose how your retirement annuity funds are invested, which we’ll discuss in more detail later. Think of the retirement annuity as a protective “wrapper” that houses your investments. The type of wrapper, in this case, the RA, determines the tax implications, as different investment wrappers have varying tax consequences. When you reach the minimum retirement age of 55, you can use the funds accumulated in your retirement annuity to invest in a post-retirement product. These products, such as living annuities or guaranteed life annuities, provide you with a regular income stream during your retirement years. Modern retirement annuities offer flexibility, allowing you to start or stop contributions based on your financial circumstances, such as periods of financial difficulty or job loss.

Exploring Investment Options for RAs

All retirement annuities in South Africa are governed by Regulation 28 of the Pension Funds Act. This regulation prescribes the allowable asset classes and maximum allocations for retirement fund investments. As per the asset allocation restrictions, a retirement annuity can invest a maximum of 75% in equities and up to 45% offshore, an increase from the previous limit of 30%. Other possible asset classes for retirement annuity investments include bonds, property, hedge funds and cash. Most retirement fund assets in South Africa are invested in balanced funds that adhere to these prescribed limits and are categorised as the South African Multi-Asset-High-Equity fund category according to ASISA.

The Biggest Benefits of a Retirement Annuity. All the Tax Benefits

Retirement annuities offer several key advantages that contribute to disciplined and flexible retirement planning. One significant benefit of a retirement annuity is that you cannot access the funds until you reach the minimum retirement age (currently 55), ensuring that your retirement planning remains on track without succumbing to temptation. (That will be changing with the new two-pot system). Let’s explore the tax benefits associated with retirement annuities:

1. Tax-Free Growth: The funds invested in a retirement annuity grow tax-free, meaning you are exempt from income tax or capital gains tax on the investment’s growth.

2. Tax-Deductible Contributions: Contributions made to a retirement annuity are tax-deductible, up to a maximum of 27.5% of your gross income or capped at R350,000 per annum. This allows you to reduce your taxable income by the amount of your contribution.

For example, let’s say you earn R1 million per year gross. Assuming no other factors, you would pay approximately R300K in taxes for the year. However, if you contribute 10% or R100K p.a. to a retirement annuity (whether monthly or as a lump sum), your taxable income decreases to R900,000. As a result, the tax you pay reduces to approximately R257K for the year, saving you over R40K in taxes.

3. Estate Duty Savings: All allowable contributions (and growth) fall outside of your estate for estate duty calculation purposes on death.

Accessing Your Retirement Annuity: Estimating Your Retirement Income

Once you reach the age of 55 or decide to retire, you can access the total value of your retirement annuity. This value comprises your contributions and the growth accumulated in your investments. You have the option to withdraw up to one-third of the total value as cash. The first R550K of this cash withdrawal is tax-free, assuming you haven’t previously utilized any portion of this tax-free allowance. The remaining balance is used to purchase a product specifically designed to provide you with a steady income stream throughout your retirement years. A rule of thumb figure to use as a sustainable income level, would be a starting drawdown rate of about 4% p.a. So for every R1 million invested you should be able to generate about R40,000 p.a. before tax. While this income is taxable, tax rates during retirement are typically lower compared to your working years. If the total value of your retirement annuity is less than R247,500, you have the option to withdraw the entire amount in cash.

Best Retirement Annuity in South Africa

Determining the “best” retirement annuity depends on your specific criteria. Factors to consider include fees, performance, and brand reputation. The brand or institution your retirement annuity is with, matters less than the underlying funds or investments held within the RA. Because the underlying investments determine the growth. So whether your retirement annuity is with Old Mutual or Allan Gray or Ninety One for example doesn’t really matter. What matters are the funds or investments you select for your RA.

Balanced funds are the type of investment that house most retirement annuity savings. And most of the best performing balanced funds you can invest in are not the big brands, but are amongst the less well-known or boutique asset managers.

We have therefore analysed Morningstar data to find the best performing balanced funds you can invest your retirement annuity savings in. *Retail fee classes used.

Top Performing Retirement Annuity in South Africa over 3 years

The PSG Balanced fund tops the list of performers with a 3-year average annual return of 16.28% p.a. All the top performers have delivered exceptional returns, especially considering the peer group average has only delivered returns of about 8.86% p.a. This category of funds typically has a benchmark return objective of Inflation Plus 5 (which is what we as financial planners typically model as the return objective needed if you want to achieve financial independence). Inflation Plus 5 equates to a return of about 10% p.a. – which these funds are comfortably delivering on. The fact that the peer group average is well below that however, is concerning. Do you know what your retirement fund investment returns are? It’s important to keep track of!

Best Performing Retirement Annuity South Africa 5 Years

The High Street High Equity Fund comes out tops over 5 years with a 13.79% annualised return figure. They’re a small fund and we’ll admit to never having heard of them. The Aylett Balanced and ABAX Balanced Funds feature again and are amongst the most consistent of the top performing funds across different time frames. Fairtree have forged a reputation has probably being the best domestic equity manager locally, so not surprising to see their balanced fund also feature. Again, all these funds are comfortably delivering on an Inflation Plus 5 return mandate, which the peer group average at 8.87%, is not.

Best Performing RA in South Africa over 10 years

The Aylett Balanced Fund tops the best performers charts over 10 years delivering a return of 10.78% p.a. The ABAX Balanced fund isn’t far behind with its 10.52% return. They are probably the two best and most consistent performing balanced funds available in South Africa.

Of the ‘brand names’ or big players – its the first time any of them make an appearance – with the Ninety One Opportunity Fund making the list. Interestingly, the other big name funds (Allan Gray Balanced, Coronation Balanced Plus, M&G Balanced) have delivered decent returns relative to the peer group average (6.87% p.a.) – but can’t be regarded as ‘top performers’ anymore.

Important Point: What is worrying is how few funds are now achieving their Inflation Plus 5 mandate (even the top performers are barely managing) – with the peer group not even close (achieving returns of clser to Inflation Plus 2). This illustrates why you need to be investing beyond just retirement annuities and other pension fund investments to achieve the investment returns needed to be able to retire in comfort.

How Do The Sygnia Skeleton Balanced 70 Fund, Satrix Balanced Index ... and Other Low-Cost Options Compare?

When assessing what constitutes the best retirement annuity in South Africa, there has been a big shift to focusing on fees, and rightly so. Sygnia, Satrix and 10X have led the way in introducing low-cost passive balanced funds that offer compelling alternatives to actively managed investments. All the funds listed have total invesment charges (TIC) in the range of 0.50%-0.70% p.a., so there isn’t much in it.

The Sygnia Skeleton Balanced 70 Fund with a TIC of 0.51% p.a. is probably the lowest cost or cheapest retirement annuity you can find, because Sygnia doesn’t charge a platform or administration fee if you invest with them directly. Of the low cost funds, the Gryphon Prudential Fund is the best performing – but it’s not actually a pure index or passive fund, unlike the others. 10X only have a performance history of 3 years according to Morningstar which why they aren’t featured.

The Gryphon Prudential Fund with an 11.05% p.a return over 5 years and 10.35% return over 7 years is comfortably the standout. It doesn’t yet have 10-year track record. The others are all fairly tightly bunched.

Comparing the performance of the best performing funds against the low-cost options does show a substantial difference in returns achieved. However, the passive funds are at least performing above the peer group average, which is significant. There are a lot of poor performing funds that don’t warrant your hard earned capital – so understanding what you’re invested in (including via your pension and provident funds) is important.

What this ultimately does demonstrate is the value of conducting thorough research to explore options beyond the familiar, including boutique managers who have delivered strong returns. Blending strong performing actively managed funds with low-cost index or passive options can also give you the best of both worlds – better performance with lower fees.

Managing Your Retirement Annuity in the Event of Your Death

In the unfortunate event of your passing, the value of your retirement annuity falls outside of your estate, eliminating the need for estate duty. The distribution of benefits is regulated by section 37C of the Pension Funds Act. Trustees of the fund exercise their discretion to identify and arrange equitable payment of the benefits to your dependents, both legal and factual, even if you have nominated a beneficiary. The definition of a dependent is broad, and the trustees have the final say, making the process potentially complicated. To better understand the intricacies and challenges surrounding section 37C, we recommend reading this informative article on the subject.

Once the trustees have determined how to distribute the benefits among your dependents, they can choose to receive the amount as cash (subject to taxation) or use the capital to purchase an income-generating product through a living or life annuity.

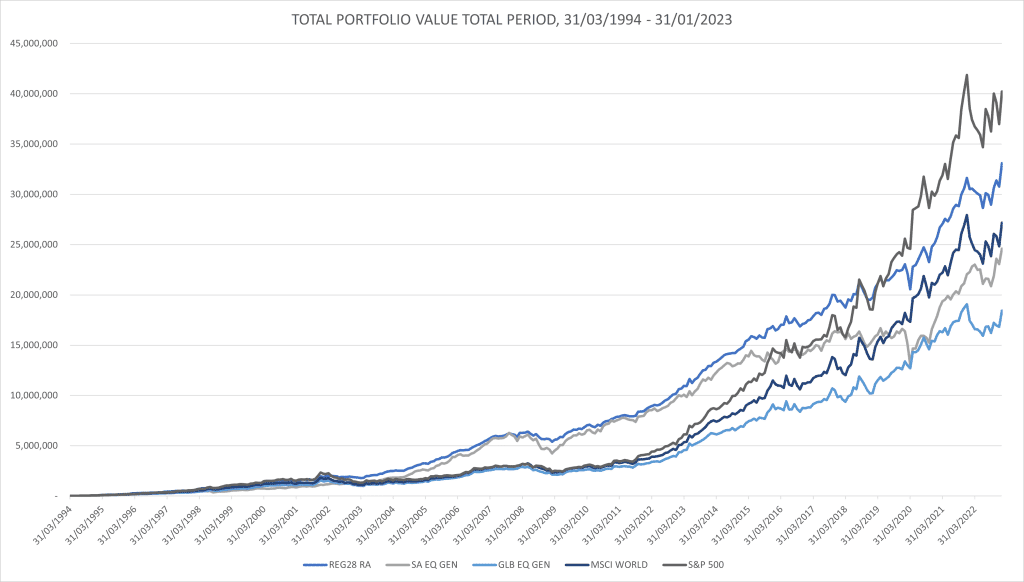

How Does Investing in a Retirement Annuity vs. Investing Offshore Compare?

A longstanding debate revolves around whether investing in a retirement annuity, with its tax benefits and advantages, outweighs the benefits of investing offshore, which offers a broader range of opportunities and potentially higher returns. Consider also that the Rand has depreciated by approximately 5-6% p.a. on average as well for the last 30 years, how do you ever make that up? That’s especially true today as more people want to be internationally mobile, travel and even emigrate. So should investing offshore not also be a cornerstone of your financial independence or retirement strategy?

Using the S&P500 as the global or offshore benchmark clearly comes out the winner. And by a long way. Long-term total returns on the S&P 500 dating back to the end of WW II are about 10% p.a. in USD terms. The period 2000-2010 where the S&P 500 went nowhere for a decade and emerging markets did fantastically due to a booming China, was the one decade where a balanced fund via a retirement annuity would have performed better.

Just to be clear, we’re not saying don’t use retirement annuities as part of a diversified retirement planning strategy – but you do need to be using a broader toolkit that includes offshore to generate the kind of long-term returns needed to achieve financial independence.

Conclusion: Weighing the Benefits of a Retirement Annuity

When assessing the benefits and drawbacks, retirement annuities continue to play a valuable role in diversified retirement investment strategies. These annuities offer significant tax and estate planning advantages, especially when considering the wide range of low-cost options available, including those managed by boutique fund managers with impressive track records.

However, relying solely on retirement annuities may not optimize your ability to achieve financial security. It is essential to explore additional options, such as investing offshore, to capitalize on the vast world of investment opportunities. The global market presents diverse possibilities, and taking advantage of them can help diversify your asset base effectively.

When opting for offshore investments, we recommend engaging in proper diversification by investing in hard currencies, such as USD, rather than relying solely on feeder funds. With streamlined processes and easier access to offshore investment opportunities, embracing these options can enhance your retirement investment strategy.

By understanding the benefits of a retirement annuity and exploring other investment avenues, you can create a comprehensive retirement plan that aligns with your financial goals and maximizes your long-term wealth potential. Remember, the world is full of opportunities—seize them wisely to secure a prosperous future.

Carl-Peter Lehmann

Carl-Peter is a Director and Partner at Henceforward. He has more than 20 years experience, is a CERTIFIED FINANCIAL PLANNER, and is passionate about helping his clients think differently when it comes to securing their retirement and financial future.