Last Updated on 26/09/2025 by Carl-Peter Lehmann

How much do you need to retire in South Africa in 2025? Retirement is one of those life milestones everyone knows is coming, yet very few feel fully prepared for. Part of the problem is the language we use. Industry jargon often talks about “replacement ratios” — the idea that you should aim to replace around 75% of your final working income in retirement. But let’s be honest: most people don’t think in replacement ratios. They think in terms of rands in the bank each month.

Another truth? No one has ever complained about having too much money at retirement. Falling short, however, is one of the most common financial regrets.

So let’s strip away the jargon and answer a simple question: how much money do you actually need to retire in South Africa today?

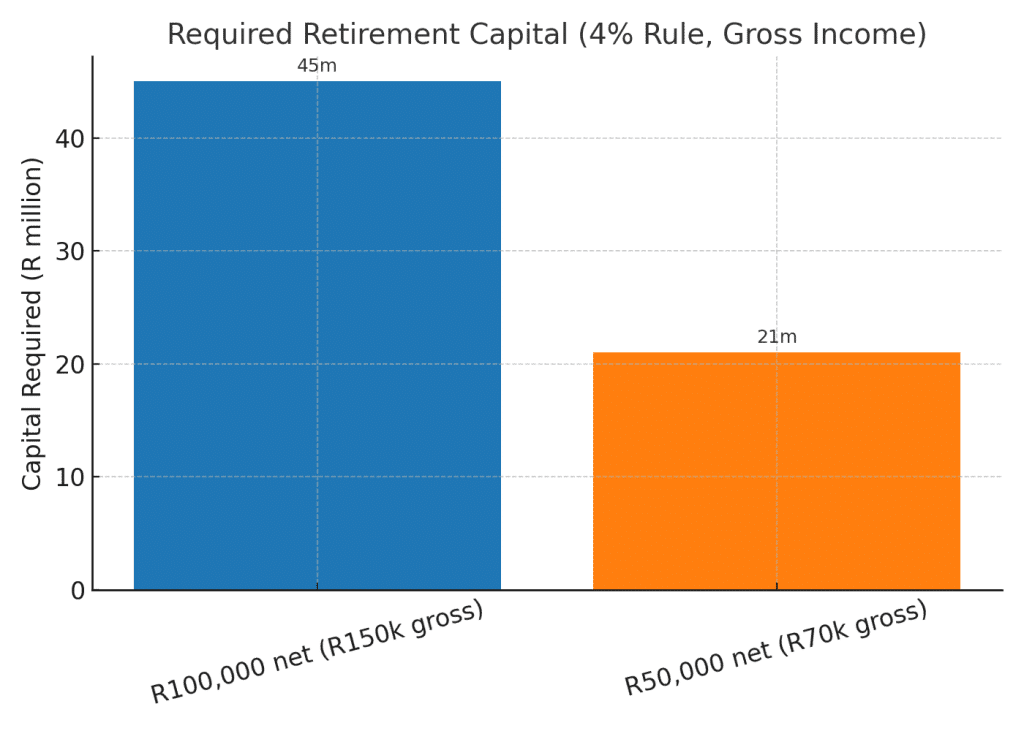

The Real Numbers: R100,000 vs R50,000 a Month

For this exercise, let’s look at two examples that cover the lifestyle spectrum:

- Scenario 1: You want a net retirement income of R100,000 per month (roughly R150,000 before tax).

- Scenario 2: You want a net retirement income of R50,000 per month (roughly R70,000 before tax).

We’ll assume retirement at age 65, with life expectancy to age 100 … that’s 35 years of income you’ll need to fund. We’ll also assume:

- You draw down at a sustainable 4% rate (a global rule of thumb).

- Your investments deliver an average Inflation +4% return post-retirement (so if inflation averages 5%, you earn 9% p.a. net of fees).

** We haven’t optimised for tax efficiency (treating all retirement income as taxable for simplicity).

How Much Capital Do You Need?

The 4% rule is a neat shortcut. It says that if you withdraw 4% of your capital each year (adjusted for inflation), your money should last a 35-year (roughly speaking) retirement. While not perfect, it gives us a reasonable ballpark.

Here’s what that looks like in practice:

📊 Table 1: Capital Required to Fund Retirement

| Retirement Income (Gross) | Required Capital |

|---|---|

| R150,000 per month (≈R100,000 net) | R45 million |

| R70,000 per month (≈R50,000 net) | R21 million |

(The 4% rule already assumes your income increases annually with inflation — so inflation is built into these figures.)

Why Returns Matter More Than You Think

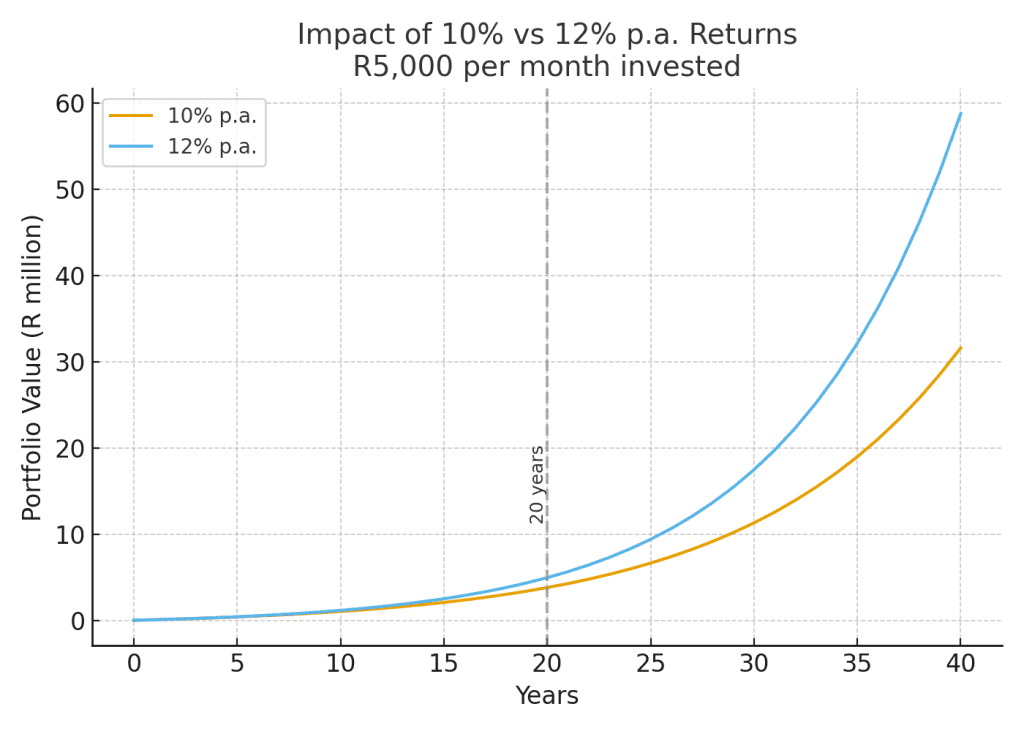

The difference between earning 10% p.a. and 12% p.a. on your investments doesn’t sound like much. But compounded over time, it’s enormous.

To make this relatable, let’s say you invest R5,000 per month.

📊 Table 2: The Power of Compounding — R5,000/month

| Return Rate | After 20 years | After 40 years |

|---|---|---|

| 10% p.a. | ≈ R3.8 million | ≈ R31.6 million |

| 12% p.a. | ≈ R4.9 million | ≈ R58.8 million |

Notice how the real acceleration happens in the second 20 years — that’s compounding doing its magic.

Now, here’s where South Africa’s regulatory framework comes in. Regulation 28 of the Pension Funds Act restricts retirement funds from investing more than 75% in equities (and only 45% offshore). While these rules are designed to limit excessive risk, they also cap potential long-term returns.

Why is this a problem? Because over 30 or 40 years of compounding, even a 2% p.a. lower return can mean the difference between a comfortable retirement and running short. Regulation 28 effectively forces most retirement savers into a slightly more conservative portfolio (forced to hold bonds) than they might ideally hold if their only goal was maximising growth (e.g. being fully invested in equities).

This is why relying solely on Regulation 28–constrained retirement funds is unlikely to generate the highest possible returns over a lifetime. Achieving a successful retirement often means blending different strategies:

1. Using retirement funds for their tax efficiency (deductions and deferred growth).

2. Complementing them with discretionary investments and offshore portfolios where you can take higher equity exposure.

3. Ensuring diversification, but also maximising return potential in a sensible way — not by going “all in” on risky bets like crypto, but by combining tax shelters, equities, alternatives, and offshore exposure in a balanced plan.

Do Read: Retirement annuities and how they can form part of your blended retirement strategy

Why These Numbers Shock People

Hearing that you might need R20–45 million to retire comfortably in South Africa can feel intimidating. But that’s what the maths says when you translate monthly income needs into capital.

Most South Africans will never reach these numbers. In fact, according to recent surveys, fewer than 6% of South Africans are on track to retire with enough. That doesn’t mean it’s impossible, but it does mean you need a plan … ideally one that starts early.

The earlier you save and invest, the more you benefit from compounding. Delay for even five or 10 years, and you’ll need to save far more aggressively to catch up.

A Few Important Caveats

While the 4% rule is a helpful guide, it’s not a law of nature. A few important nuances:

1. Tax efficiency matters. In practice, not all retirement income is fully taxable. With smart structuring … blending retirement annuities (for the tax deduction), living annuities, discretionary investments, and offshore portfolios … you can reduce your effective tax rate.

2. Drawdown flexibility is key. In poor market years, you may need to tighten your belt and withdraw less. Sticking rigidly to inflation-adjusted increases every year can increase the risk of running out of money.

3. Longevity risk. Living to 100 may sound extreme, but medical advances are making longer lives more common. Planning for 35 years (and potentially longer) is prudent.

4. Inflation can surprise. If inflation averages more than 5% (or whatever you think is a realistic benchmark), your required returns rise. If it’s less, you’ll have more breathing room.

5. Lifestyle choices. Not everyone needs R100,000 per month. For some, R50,000 (or R30,000) might be sufficient. For others, even R150,000 isn’t enough.

6. Guaranteed life annuities. We haven’t factored these in here, but they are worth mentioning. Life annuities currently offer much higher starting incomes than in the past, thanks to the interest rate environment. They also remove the risk of outliving your capital, because the income is guaranteed for life. The trade-off is that you give up flexibility and the ability to leave capital behind.

Further Reading: Understanding living annuities, drawdown rates, and how to make your capital last in retirement

Bringing It Back to You

The key takeaway isn’t that you need exactly R21 million or R45 million. It’s that:

- Retirement is expensive because it has to fund decades of living costs without a salary.

- The income you want dictates the capital you need.

- Small differences in returns, fees, and tax efficiency compound into life-changing outcomes.

- Relying only on Regulation 28–restricted retirement funds may not get you there.

- The question, then, isn’t just “how much do I need to retire?” It’s also:

- Am I saving and investing enough today?

- Are my investments structured to deliver inflation-beating returns?

- Do I understand the risks — longevity, inflation, market downturns — and have I built a plan resilient enough to handle them?

Final Thoughts

Retirement planning in South Africa requires clear eyes and early action. Industry jargon about “replacement ratios” hides the real question: how much do you actually need in rands and cents to live the life you want when you stop working?

For someone who wants R100,000 per month net, the answer is roughly R45 million (in today’s terms). For someone targeting R50,000 per month net, the answer is about R21 million. Both assume disciplined investing, sustainable drawdowns, and a long retirement.

But equally important: don’t let Regulation 28 limit your long-term wealth-building. Yes, use retirement funds for their tax perks — but combine them with discretionary and offshore strategies to ensure you’re maximising returns where it matters most.

Ultimately, a comfortable retirement looks different for everyone. Having rough benchmarks is useful, but the real value comes from a personalised retirement strategy … one that’s customised to your lifestyle, investment choices, and goals. That’s where working with a professional financial planner makes all the difference: creating clear benchmarks, guiding your investment strategy, and helping ensure you stay on track.

Further Reading: Your comprehensive guide to understanding retirement in South Africa

Carl-Peter Lehmann

Carl-Peter is a Certified Financial Planner® and Director at Henceforward, an independent wealth management and financial planning firm based in South Africa. With more than 20 years of experience in global wealth management, he specialises in retirement planning and offshore investments. At Henceforward, Carl-Peter and his team provide holistic, flat-fee financial advice to help clients build resilient portfolios and achieve long-term financial security.