Last Updated on 31/08/2025 by Carl-Peter Lehmann

What Are the Best-Performing Global Equity Unit Trust Funds in 2025?

As we head into the end of August and the start of spring in South Africa, 2025 has kept investors busy – tariff headlines, April’s sell-off, and a sharp rebound since. It’s a good moment to reassess how Global Equity funds are stacking up versus a more competitive local market.

Important context: Unless stated otherwise, all results in this article are for South African–domiciled, rand-priced (ZAR) offshore funds in the ASISA Global Equity General category … this includes ZAR feeder funds and locally listed ETFs … so returns reflect both underlying market performance and rand moves. (ETFs are now included in the relevant ASISA categories and therefore appear in these rankings.)

Over the past decade, global equities have been powerful compounding engines – helped by durable secular themes (notably U.S. technology) and periods of rand weakness. More recently, SA equities have shown signs of life on commodity strength and a steadier currency, but global markets still provide diversification, sector breadth, and exposure to world-leading innovators.

With data to 25 August 2025, the tables that follow highlight the top performers over 3, 5 and 10 years, alongside peer context to help you judge which strategies are truly delivering for South African investors accessing offshore growth in rand terms.

Why Offshore Equities for South African Investors?

While the JSE has its merits, it represents a small slice of the global economic pie. Offshore equities offer diversification not just in terms of geography but also sectors, giving you access to industries and technologies that may be under-represented locally like AI. Investing globally can act as a hedge against local economic uncertainties, political instability, and the devaluation of the Rand.

1. Ease of Investment

One of the advantages of Global Equity Unit Trusts is that they provide a straightforward gateway to international markets without the complexities of moving money offshore (although that remains our preferred strategy once your income level and/or wealth warrants it). Investing in these unit trusts is as simple as investing in any South African-based unit trust, eliminating the need for tax clearance from SARS (once you go above your R1 million annual discretionary allowance) or complicated tax reporting (even though these days it’s not that complicated and we help our clients with that).

2. Devaluation of the Rand

The Rand has historically been a volatile currency, subject to long-term depreciation. 10 years ago the USD/ZAR exchange rate was about 10.50. As of today, it hovers between 17.50-18.00. You do the maths and what that means to your global purchasing power, ability to travel and achieve or maintain real financial security? Investing in global equities offers a hedge against this currency risk. While your offshore investments may appreciate in value, you could also benefit from any weakening of the Rand, as your global assets would then be worth more in local currency terms.

3. Tax Basics - 'Direct' Offshore vs Feeder Fund

One of the reasons why we prefer direct offshore exposure whenever possible for our clients (aside from the security of having your money outside local borders) – is the impact of currency fluctuations on your investment returns and the consequent tax implications. Returns calculated in hard currency (e.g., USD when your money is actually offshore) – are not subject to exchange rate fluctuations. In other words, if your USD investment appreciates or depreciates by 10% – that is your gain or loss and makes the tax calculation simple. If investing offshore in ZAR – a 10% gain in USD terms could be boosted or dampened by Rand volatility. If the Rand say depreciates by 5% during the same time frame, your gain is suddenly 15%. If the Rand strengthens by 5%, your gain is now only 5%. Not the end of the world, but not ideal either.

Further Reading: Offshore Investing 101 and How to Go About It Properly

4. Unveiling Great Investment Opportunities

Global Equity unit trusts offer South African investors a ticket to participate in the growth stories of powerhouse companies like Nvidia, Microsoft, Eli Lilly, and Crowdstrike — entities not listed on the JSE. This allows you to tap into disruptive technologies and trends that are shaping the future, from clean energy and electric vehicles to AI, cybersecurity and cloud computing.

Consider Reading: Our Top Global Share and Stock Investment Ideas for 2025

How We Identify the ‘Best Performing’ Unit Trusts in the Global Equity Fund Category

Choosing the best performing unit trusts in the global equity category requires a nuanced approach. It’s not just about raw returns – risk, quality considerations, and asset manager capabilities all play a role. In this article, we focus on long-term annualized returns to assess which funds and asset managers have consistently delivered strong results, outperforming their peers.

That said, this is not an investment recommendation. Performance alone doesn’t determine whether a fund is the right fit for an investor’s portfolio, and there may be funds on this list we wouldn’t necessarily recommend clients commit capital to. Instead, this is a fun and insightful exercise meant to spark ideas and inspire further research.

Performance figures are sourced from Morningstar (as at 25/08/2025), with retail fund prices used.

A Few Key Considerations

Some of the most highly regarded foreign asset managers – including Fundsmith, T. Rowe Price, Sands Capital, and Lindsell Train – have only fairlyly recently introduced feeder funds for South African investors. As a result, their longer-term performance stats aren’t yet reflected in Morningstar’s historical rankings.

Many funds listed under local asset management brands are actually managed by foreign firms. For example, the Old Mutual Global Equity Fund is managed by Jupiter Asset Management.

Understanding the Impact of Currency Volatility on Offshore Fund Performance

When evaluating the performance of Rand-denominated offshore funds, it’s important to consider the outsized impact of currency movements on returns. So far in 2025, the Rand has done well against the U.S. dollar — supported by stronger commodity prices and a degree of renewed investor interest in emerging markets. As a result, the currency tailwind that previously boosted global equity returns for South African investors has faded somewhat, with offshore fund performance now reflecting more of the underlying market returns rather than being amplified by Rand weakness.

In fact, over the year-to-date, 1-year, and 5-year time frames, we’ve seen local SA equity funds outperform their global counterparts, reversing the trend that dominated much of the previous decade. This shift reinforces why investors must view global equity performance through both a market and currency lens, particularly when investing in Rand-denominated offshore funds.

With that context in mind, let’s explore the top-performing global equity unit trusts over the 3-, 5-, and 10-year periods — and see which managers have consistently delivered despite the changing macro and currency landscape.

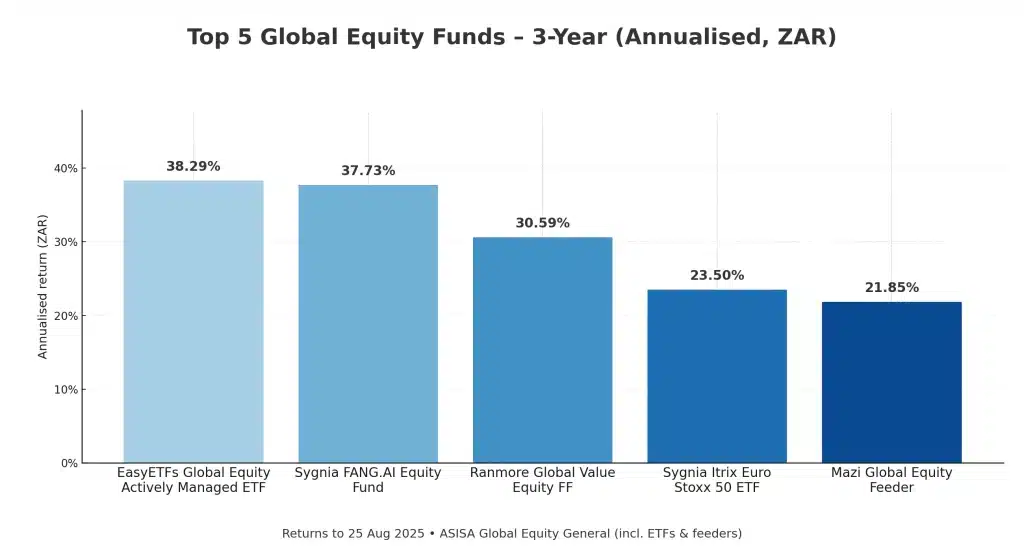

Best Performing Unit Trusts - Global Equity Fund Performance over 3 Years in ZAR

With 133 global equity funds showing a full 3-year record, the peer-group median is 15.95% p.a. Despite a volatile macro backdrop, leadership has been clear: a handful of tech-tilted and dynamic strategies have delivered returns far in excess of the median.

Top 5 Best-Performing Global Equity Funds (3-Year Performance to 25 August 2025)

| Rank | Fund | 3-Year (ann.) |

|---|---|---|

| 1 | EasyETFs Global Equity Actively Mngd ETF | 38.29% |

| 2 | Sygnia FANG.AI Equity Fund | 37.73% |

| 3 | Ranmore Global Value Equity FF | 30.59% |

| 4 | Sygnia Itrix Euro Stoxx 50 ETF | 23.50% |

| 5 | Mazi Global Equity Feeder Fund | 21.85% |

🔹 EasyETFs Global Equity Actively Managed ETF (~38.29% p.a.): A dynamic overlay on a broad global base captured shifting leadership and AI momentum.

🔹 Sygnia FANG.AI Equity (~37.73% p.a.): Concentrated exposure to mega-cap tech/AI winners amplified upside in the rebound.

🔹 Ranmore Global Value Equity Feeder (~30.59% p.a.): Value discipline worked … owning cash-generative, reasonably priced global names.

🔹 Sygnia Itrix Euro Stoxx 50 ETF (~23.50% p.a.): Europe’s large-cap quality and cyclicals contributed meaningfully over this window.

🔹 Wide dispersion: The spread between the median (~15.95%) and the winners (high-30s) shows how factor tilts and active overlays drove outcomes.

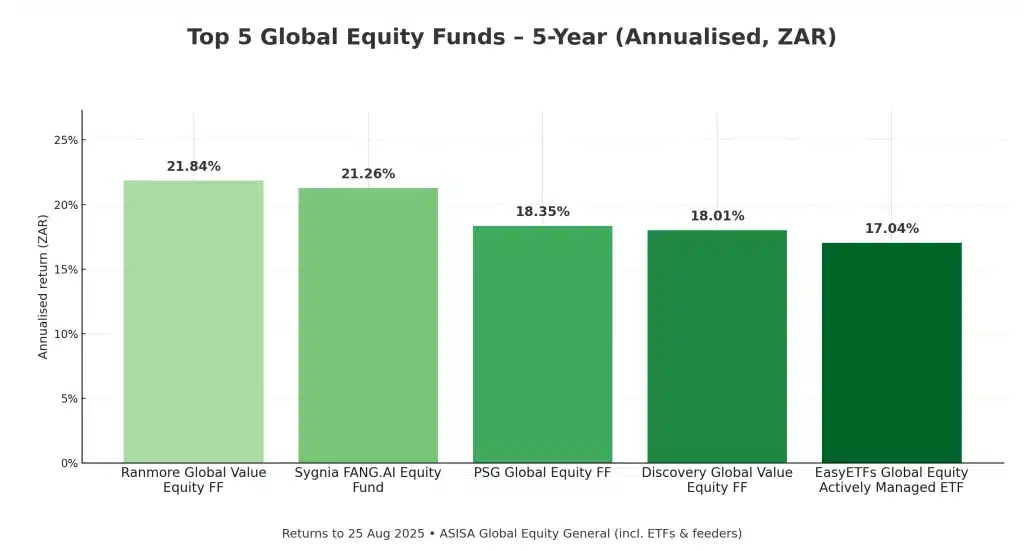

Best Performing Global Equity Unit Trust Funds Over 5 Years in ZAR

Across 91 funds with five-year histories, the peer-group median sits at 11.16% p.a. The top strategies paired disciplined factor exposure with stock-level selection, compounding well ahead of the field.

Top 5 Best-Performing Global Equity Funds (5-Year Performance to 25 August 2025)

| Rank | Fund | 5-Year (ann.) |

|---|---|---|

| 1 | Ranmore Global Value Equity FF | 21.84% |

| 2 | Sygnia FANG.AI Equity Fund | 21.26% |

| 3 | PSG Global Equity FF | 18.35% |

| 4 | Discovery Global Value Equity FF | 18.01% |

| 5 | EasyETFs Global Equity Actively Mngd ETF | 17.04% |

🔹 Ranmore Global Value Equity Feeder (~21.84% p.a.): Value-led, quality-aware process at the top … ~10.7ppt ahead of the median.

🔹 Sygnia FANG.AI Equity (~21.26% p.a.): Growth/AI tilt sustained leadership beyond the initial surge.

🔹 PSG Global Equity Feeder (~18.35% p.a.) & Discovery Global Value Equity Feeder (~18.01% p.a.): High-conviction active cores with consistent selection effect.

🔹 EasyETFs Global Equity Actively Managed ETF (~17.04% p.a.): Active ETF overlay helped keep pace with top active peers.

🔹 FX matters: Returns are in rand; rand moves influenced feeder-fund outcomes – another reason to compare across multiple horizons.

Now Read: Henceforwards Role in Providing Global Investment Advisor Services

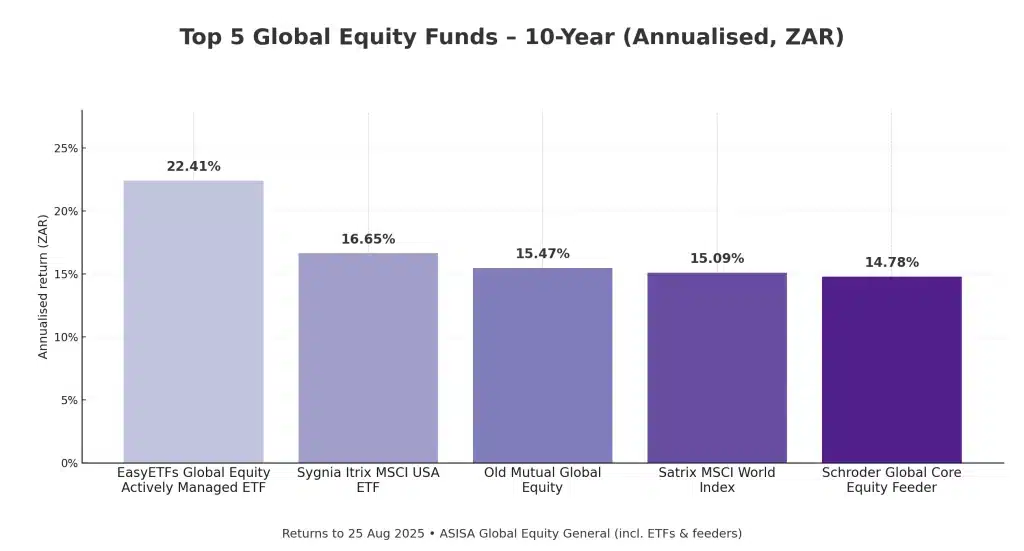

Top Global Equity Fund Performers over 10 Years - Rand Denominated

Only 40 global equity funds make the 10-year cut, with a peer-group median of 12.74% p.a. The leaders below have delivered durable compounding through multiple cycles and factor regimes.

Top 5 Best-Performing Global Equity Funds (10-Year Performance to 25 August 2025)

| Rank | Fund | 10-Year (ann.) |

|---|---|---|

| 1 | EasyETFs Global Equity Actively Mngd ETF | 22.41% |

| 2 | Sygnia Itrix MSCI USA ETF | 16.65% |

| 3 | Old Mutual Global Equity | 15.47% |

| 4 | Satrix MSCI World Index | 15.09% |

| 5 | Schroder Global Core Eq Feeder | 14.78% |

Key Takeaways

🔹 EasyETFs Global Equity Actively Managed ETF (~22.41% p.a.): Decade-long leader … dynamic, theme-aware approach added to broad global exposure.

🔹 Sygnia Itrix MSCI USA ETF (~16.65% p.a.): Long US large-cap dominance (profitability + innovation) did the heavy lifting.

🔹 Old Mutual Global Equity (~15.47% p.a.) & Satrix MSCI World Index (~15.09% p.a.): Quality/growth-tilted active core and a low-cost global index both compounded strongly.

🔹 Schroder Global Core Equity Feeder (~14.78% p.a.): Diversified, quality-biased core delivered steady alpha.

🔹 Lesson: Over long horizons, pairing a low-cost global core with select active or dynamic satellites has been a reliable route to outperformance.

Consider Reading: Some of the Best Performing Hedge Funds in South Africa and How They Compare

How We Approach Global Investing for Clients

Investing in global equity unit trusts is as straightforward as making a local investment – whether through a lump sum or a monthly contribution, the process is typically hassle-free. However, simply picking funds based on past performance is a recipe for disaster. The best-performing global equity funds over the next decade will likely look very different from those topping the charts today.

That’s why our approach to global investing is strategic and tailored to each client’s unique financial plan. Where it makes sense and is possible, we invest directly offshore, giving clients access to a broader range of opportunities, lower-cost structures, and institutional-level investment options. However, we also recognize the value of Rand-based offshore strategies, which provide global diversification while maintaining liquidity and simplicity within local investment structures.

Another key element of our strategy is the balance between active and passive investing. While passive strategies – such as index funds and ETFs – offer cost efficiency and broad market exposure, active management can add value through tactical asset allocation, sector tilts, and downside risk management. The best results often come from blending both approaches, ensuring a cost-effective, globally diversified portfolio tailored to long-term investor outcomes.

Ultimately, understanding your lifestyle, financial needs, and long-term goals is far more important than chasing past performance. A well-structured portfolio should be built with purpose and discipline, ensuring it remains resilient across different market cycles and currency fluctuations.

Now Read: Our Guide on Offshore Investing and Some of the Best Direct Offshore Funds Available Currently

Closing Thoughts on the Best PerformingUnit Trusts in the Global Equity Fund Space

For South African investors, global equity unit trusts offer far more than just diversification. They act as a hedge against local economic and currency risks while providing access to global industries, innovations, and opportunities that are difficult to tap into through domestic markets alone. Investing globally has never been easier, but with an ever-expanding range of funds and strategies, navigating this space requires careful consideration.

At Henceforward, we take a deliberate, structured approach to global investing – helping clients blend active and passive strategies, balance direct offshore and Rand-based offshore solutions, and most importantly, align their portfolios with their long-term goals, values, and risk tolerance. The right investment strategy is never just about chasing past performance – it’s about building a portfolio designed to stand the test of time.

Disclaimer: This article is for information purposes only and should not be construed as financial advice. Never invest in a fund solely based on past performance. Always consider your personal financial situation and seek professional advice before making investment decisions.

Carl-Peter Lehmann

Carl-Peter is a Certified Financial Planner (CFP®) and Director at Henceforward, with over 20 years of experience in wealth management and offshore investing. Having worked in global financial centers, he specializes in helping South African investors navigate international markets and build globally diversified portfolios.

Download the Henceforward “8 Secrets to Investment Success” Guide

Not on our newsletter yet? You can still grab your copy of our 8 Secrets to Investment Success – a practical, jargon-free guide to making smarter investment decisions.

What you’ll learn (in plain English):

1. The core principles that compound results over time

2. How to build a simple, resilient investment process

3. Common mistakes to avoid (and what to do instead)

4. A checklist you can use before every investment decision

Whether you’re aiming for financial independence, a stronger retirement pot, or just more confidence with your money, this guide gives you a clear, repeatable framework – no hype, no fluff.

Get the guide now — or subscribe to our newsletter and it’ll be sent to you automatically.