Last Updated on 17/07/2025 by Carl-Peter Lehmann

10 Biggest Retirement Planning Mistakes to Avoid (And What to do Instead): Retirement planning has always been a complex task, but in 2025 … with longer lifespans, lower returns, and shifting regulations … it’s more important than ever to avoid costly missteps. Here’s an updated list of the biggest retirement planning mistakes we see South Africans making today, plus two fresh insights that didn’t even make the radar a few years ago.

1. Underestimating How Long You’ll Live

Most people still base their retirement planning on living to 80 or 85. But medical advances, healthier lifestyles, and family history mean you could live into your 90s or even beyond 100. That means your retirement could last 30 – 40 years – longer than your working life. Planning for 20 years of retirement might leave you broke in your 80s. Use conservative longevity assumptions and ensure your portfolio can sustain you for the long haul.

2. Assuming You’ll Earn Inflation Plus 5%

The 10% return myth remains stubbornly persistent. Yet, many Regulation 28-compliant balanced funds have struggled to deliver even CPI+3% over the past decade, with the median return sitting at just 7.46% p.a. (as at 17 July 2025, according to Morningstar). While the 5-year median return is more encouraging at 10.78% p.a. – comfortably meeting the Inflation Plus 5% benchmark – once you factor in advice and admin/ platform fees, investors still fall short of their real return targets. Offshore diversification and a broader asset mix can improve outcomes, but relying on outdated return assumptions leaves retirement plans vulnerable to future shortfalls. Instead, plan around more realistic expectations (CPI+3–4%) and consider supplementing traditional retirement vehicles with discretionary and offshore investments to unlock better growth potential. And most importantly, review your plan regularly to stay aligned with an evolving market environment.

Now read: The benefits of retirement annuities and the best performing balanced funds for your RA.

3. Ignoring the Impact of High Fees

An all-in annual fee of 1% might sound reasonable … but in reality, it’s increasingly unrealistic. Most investors face a higher Effective Annual Cost (EAC), which includes the Total Investment Cost (TIC), plus administration and financial advice fees. While the TIC is already accounted for in the net performance published on fund fact sheets, the admin and advice components are not. That means your actual return – what lands in your pocket – can be significantly lower than headline figures suggest. The most important number to track is your personal IRR (internal rate of return), net of all fees. That’s what determines whether your investment strategy is on track to meet your long-term goals. If your IRR consistently lags behind your required return (e.g., inflation plus 5%), it’s time to reassess your costs, portfolio structure, or both.

Now Read: Henceforward’s Unique Flat Fee Model which is perfect for Retiree Investors

4. Overconcentration in South African Assets

South Africans often overinvest locally due to Regulation 28 restrictions and familiarity bias. But the JSE represents less than 1% of global equities – and the rand is structurally weak. This makes offshore diversification not just smart, but necessary. Whether via feeder funds, offshore platforms, or foreign-currency endowments, building global exposure is one of the best long-term hedges you have – especially if your retirement goals include travel, children abroad, or emigration options.

Further Reading: Offshore Investing 101 for Every South African

5. Taking Too Little Risk - Especially Too Early

It’s natural to want to dial down risk as you approach retirement, but many investors go too conservative, too soon. Growth assets – especially equities – are still essential, even in retirement, because they’re the only asset class likely to consistently outpace inflation over the long term. The real challenge for retirees isn’t volatility itself, but sequence-of-returns risk – the risk of poor market returns in the early years of retirement when you’re drawing an income. Fortunately, this can be managed without abandoning growth. Incorporating hedge funds, alternative assets, and smoothing funds into your portfolio can provide downside protection while keeping you invested in return-generating assets. The goal is to maintain sufficient exposure to growth, but to structure the portfolio in a way that cushions short-term shocks and supports long-term sustainability.

Now Read: Investment Advice for Retirees and Better Understanding Sequence Risk

6. Not Understanding the Numbers

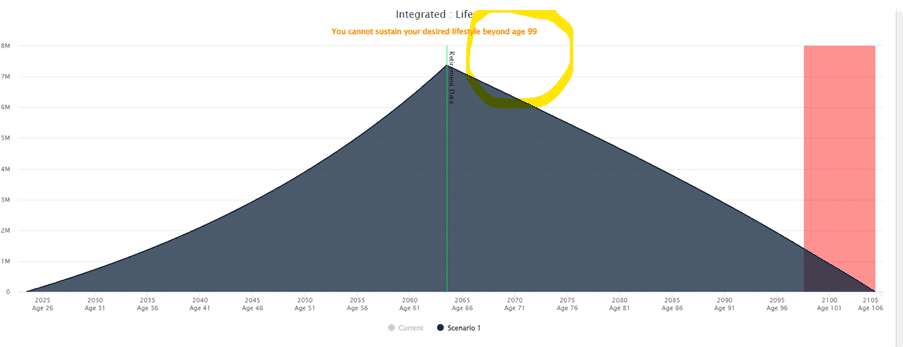

Planning for retirement without knowing your numbers is like building a house without a blueprint. You need to know your required income, withdrawal rate, tax implications, inflation assumptions, and life expectancy projections.

You’ve done everything right … diligently saved 17% of your income for 40 years (which we’ve been told is needed to achieve a RR or replacement ratio 0f 75%), aiming for that ‘successful’ retirement everyone talks about. But the markets haven’t played along. Your retirement fund returns have fallen short of the inflation-plus 5% benchmark needed to make the plan work. And the result? Your capital starts depleting rapidly. By age 74, you’re in trouble – your money is running out far sooner than expected.

What might seem like a small change has massive ramifications. In this scenario, you’re actually achieving the returns you need – around 10% per annum, or inflation plus 5%. Suddenly, your capital lasts well into old age, and you can sleep easy knowing your retirement plan is on track and financially sustainable.

7. Cashing Out When Changing Jobs

Too many South Africans still take lump sums from retirement funds when changing employers, despite having preservation options. The introduction of the Two-Pot System has made preservation more structured, but leakage still occurs – especially among younger savers. Taking a payout in your 30s can cost you millions in lost compounding over a lifetime. Preserve, preserve, preserve.

Read More: The Two Pot Retirement System and How that Impacts You

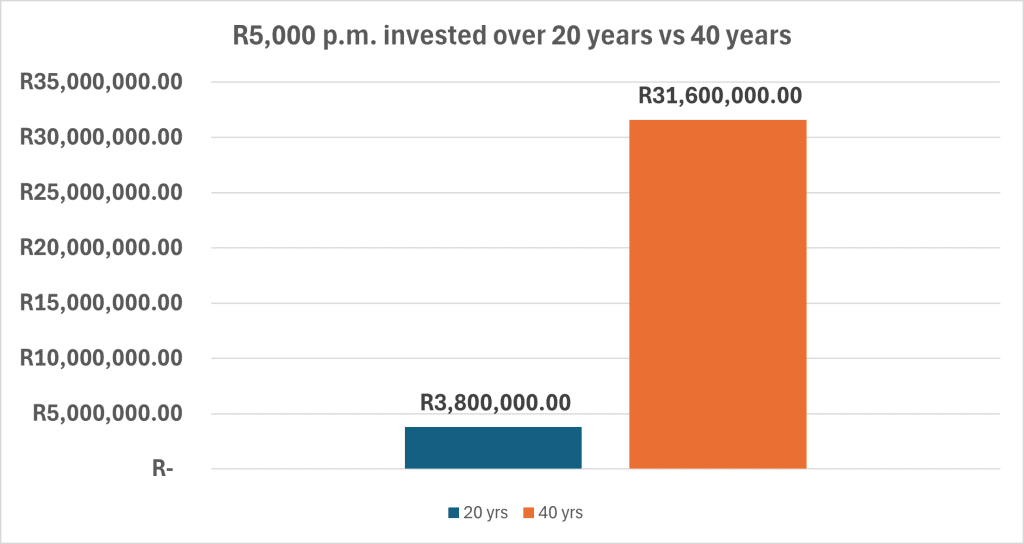

8. Underestimating the Power of Compound Growth

Time is your most powerful investment ally – but only if you use it well. The difference between starting early and starting late is staggering. Take a look at the chart below: investing R5,000 per month for 20 years gives you around R3.8 million. But stretch that same contribution out over 40 years, and it grows to an incredible R31.6 million. That’s the magic of compounding. The lesson? Start early, stay consistent, and increase your contributions over time. Indexing your savings to inflation or salary growth helps unlock the full power of compounding—and ensures you’re not left playing catch-up later in life when time is no longer on your side.

9. Trying to Do It All Yourself

It’s tempting to go it alone, especially with so much information freely available. But retirement planning is one area where the stakes are too high for guesswork. Mistakes aren’t always visible until years later—by which time they’re expensive to undo. A skilled, independent financial planner helps you avoid blind spots, bring objectivity, and create a withdrawal strategy that aligns with your lifestyle, tax profile, and investment risk.

Further Reading: Your Definitive Retirement Planning Guide in South Africa

10. Sticking to an Outdated View of Retirement

Retirement isn’t what it used to be. For many, it’s no longer a full-stop event at 60 or 65, but a transition into something more flexible—part-time work, consulting, second careers. A rigid plan that assumes no income from age 60 onward is out of sync with reality. Your planning should allow for multiple income sources, evolving lifestyle needs, and changing health or care costs over time.

Closing Remarks on the 10 Biggest Retirement Planning Mistakes

Retirement is no longer just about accumulating a pot of money. It’s about crafting a flexible, well-reasoned plan that can adapt to changing markets, tax laws, interest rates, health, and personal goals. Avoiding these 12 common mistakes can help you get there with confidence—and with your lifestyle intact.

Ready to take the next step?

If you’re approaching retirement – or already there – and want to make smarter, more confident financial decisions, the Henceforward Retirement Insights Report 2025 is essential reading.

It’s packed with up-to-date research, real-world strategies, and clear guidance on how to navigate investment returns, tax efficiency, annuity options, drawdown strategies, and much more.

Whether you’re looking to stretch your capital, optimise your income, or protect your legacy, this report will help you avoid the most common pitfalls and build a retirement plan that truly works for you.

Download your free copy and take control of your financial future with clarity and confidence.

Carl-Peter Lehmann

Carl-Peter is a Director and Partner at Henceforward, with over 20 years of experience in wealth management and financial planning. A CERTIFIED FINANCIAL PLANNER™ and former advisor at leading global institutions, Carl-Peter specialises in helping clients approaching or in retirement navigate complex decisions with clarity and confidence. He’s passionate about challenging outdated financial assumptions and crafting modern, effective strategies that support lasting financial security.