Last Updated on 11/09/2024 by Carl-Peter Lehmann

Navigating retirement savings can be complex, and the government has made recent changes to help us better prepare for the future. One of the key developments is the Two-Pot Retirement System, which also includes the GEPF Two-Pot System. After much discussion between industry and government, the system officially took effect on 1 September 2024. Let’s take a closer look at what these changes mean for you.

Table of Contents

What's This Two-Pot System All About?

Think of your retirement savings as a single cake. Until now, it’s been whole—straightforward but not very flexible. The new Two-Pot System slices that cake into three portions, each serving a different purpose. The goal? To help you save more effectively for retirement while still offering a financial safety net for those unexpected life moments. As of 1 September 2024, the system has officially been implemented. Here’s what you need to know about how it works:

How Does the 2 Pot System Work?

As of September 1, 2024, every rand you save towards retirement will be split into three distinct parts:

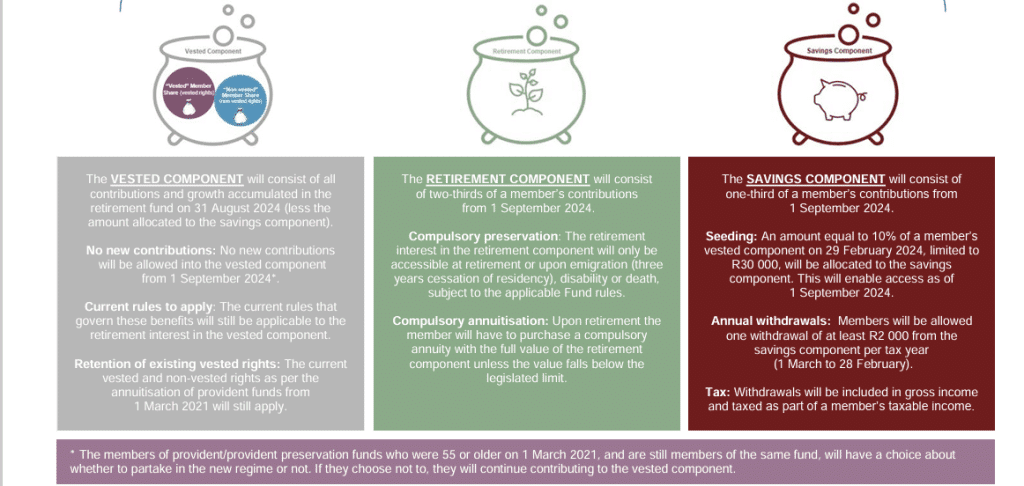

1. The Vested Component: This is your “old money”—what you’ve already saved up until August 31, 2024. It’s a snapshot of your retirement savings to date, minus a little bit that goes into the new savings slice. No new contributions here, just the growth of what’s already in the pot.

2. The Retirement Component: Think of this as the “for later” slice. It’s two-thirds of your new contributions from September 1, 2024, onwards. You can’t touch this until you retire, or in specific situations like emigration, disability, or, well, the end of the line.

3. The Savings Component: Here’s the new and exciting part. One-third of your new contributions go here. Plus, a little seed money from your vested component to get things started – 10% but capped at R30K. This slice is for emergencies. Need cash? You can dip into this once a year, with some tax implications.

Who's the Two Pot Retirement System For and How Does It Affect You?

If you were 55 or older by March 1, 2021, and are still hanging with the same fund, you’ve got options. Stick with the old way, or dive into the new system. Your call.

Why Does It Matter?

The two-pot system is shaking up the retirement savings scene for a good reason. It’s all about balance—saving diligently for the future while acknowledging that sometimes, life happens, and you might need access to your funds.

So, What’s Next?

Now that the Two-Pot System has been implemented as of 1 September 2024, the next step is the confirmation of the seeding of your savings pot. Once that’s in place, you’ll face some important decisions. While the savings pot offers flexibility, it’s crucial to only use these funds for genuine emergencies. Every withdrawal you make reduces the amount available to support you in retirement. It’s a choice that shouldn’t be taken lightly, as preserving your retirement fund remains the best path to long-term financial security.

Case Study: John’s Retirement Journey

Consider the scenario of John, a 56-year-old retirement fund member who plans to retire at 65. By the time he retires, John has accumulated savings across all three pots: the Retirement Pot, the Savings Pot, and the Vested Pot, with a total retirement savings amount of R9,600,000.

Total Retirement Savings: A Complete Picture

John’s total retirement savings across all pots sum up to R9,600,000:

1.Retirement Pot: R6,000,000

2.Savings Pot: R900,000

3.Vested Pot: R2,700,000

By understanding the tax implications of each component, John can effectively plan his withdrawals to minimise his tax burden while ensuring both immediate financial needs are met and long-term income security is established through various annuity options.

1. The Retirement Pot: Ensuring a Secure Income

John’s Retirement Pot has grown to R6,000,000, which is intended to provide a sustainable income throughout his retirement. At retirement, the funds in the Retirement Pot must be used to purchase an annuity. John can choose from various annuity options:

1.Life Annuity: Provides guaranteed income for life, ensuring that John won’t outlive his savings. The drawback is that it typically doesn’t leave anything for heirs.

2.Living Annuity: Offers flexibility, allowing John to adjust his withdrawal rates within regulated limits. This option is ideal for those who want more control but comes with the risk of depleting the funds if withdrawals are too high or investment returns are poor.

Since the entire R6,000,000 in the Retirement Pot must be used to purchase an annuity, no lump sum tax applies at the point of retirement. The income John receives from the annuity will be subject to income tax, based on his marginal tax rate in retirement.

2. The Savings Pot: Access for Immediate Needs

John’s Savings Pot contains R900,000. At retirement, he can withdraw the full amount as a lump sum, which is subject to income tax. The amount withdrawn will be added to John’s other taxable income for the year and taxed according to his marginal tax rate.

John opts to withdraw the full amount to settle his mortgage and cover relocation costs to a smaller home closer to family. He should be aware that this withdrawal will increase his taxable income for the year, potentially pushing him into a higher tax bracket.

3. The Vested Pot: Balancing Lump Sum and Annuity Options

John’s Vested Pot holds R2,700,000 accumulated before the Two-Pot System was implemented. Following the previous rules, he can withdraw up to one-third of this pot as a lump sum, with the remaining two-thirds required to purchase an annuity.

John decides to take R900,000 as a lump sum. This withdrawal is taxed according to the retirement fund lump sum tax table, which has more favourable tax rates compared to standard income tax rates. For example, the first R550,000 of lump sum withdrawals from retirement funds is typically tax-free, while amounts above this threshold are taxed at increasing rates.

The remaining R1,800,000 must be used to purchase an annuity, and no lump sum tax will apply to this portion. The income John receives from this annuity will be taxed as normal income.

Navigating the GEPF Two Pot System: What does it mean for GEPF Members?

As South Africa implements the Two-Pot Retirement System, attention is focused on how this reform will reshape the retirement savings landscape, particularly for members of the Government Employees Pension Fund (GEPF). As a defined benefit fund, the GEPF has unique considerations under this new system. Here’s a look at how the Two-Pot System impacts GEPF members and what it means for their financial planning.

Tailored Impact for GEPF Members

While the two-pot system introduces significant changes across the board, GEPF members will experience these changes with nuances unique to the fund’s framework:

• Preservation of Existing Benefits: The introduction of the two-pot system doesn’t alter the fundamental benefits for current GEPF members. The traditional structure of receiving a lump sum alongside a monthly pension remains intact. Members’ existing savings will transition into the vested pot, with access limited to retirement or resignation scenarios.

• Access with Accountability: The new framework divides new contributions between the retirement and savings pots. The latter offers a degree of liquidity, albeit with certain constraints. Withdrawals, taxable and limited to one per fiscal year, cater to immediate financial needs while promoting judicious financial behavior.

• Secured Retirement Savings: A significant portion, two-thirds, of new contributions will feed into the retirement pot. This segment remains untouchable until retirement, ensuring the primary goal of securing pension income aligns with the GEPF’s commitment to its members’ future financial stability.

Futher Reading: Are You Retiring from the GEPF Soon? Read our latest piece on your options to make sure you secure the best retirement for yourself.

How the Two Pot System Works for GEPF Members

From 1 September 2024, your pensionable service will be split into three categories:

1.Vested Service Period – For members who joined GEPF before 1 September 2024, any savings accumulated until 31 August 2024 will be allocated to the vested pot.

2.Savings Service Period – One-third of your pensionable service from 1 September 2024 onwards will go into the savings pot. Your initial seed capital is capped at 10% or a maximum of R30,000.

3.Retirement Service Period – Two-thirds of your pensionable service from 1 September 2024 will be allocated to the retirement pot.

Each year, 4 months of your service will be directed to the savings pot and 8 months to the retirement pot. You can withdraw from the savings pot once per year, subject to taxation, but the retirement pot is locked until you retire, die, or in certain cases like divorce.

GEPF Member Two Pot Case Study

Key Points for GEPF Members Under the Two-Pot System:

1.Non-taxable Transfers: Transfers between the different pots based on pensionable service periods are not taxable.

2.Tax on Withdrawals: Withdrawals from the fund upon exiting will be taxed at retirement tax rates. Benefits withdrawn from the savings pot are taxed at the member’s marginal tax rate.

3.Beneficiary Payments: Provisions for payments to beneficiaries of deceased members remain unchanged; beneficiaries will continue to receive benefits from all three pots.

4.Divorce Implications: In the event of a divorce, withdrawals will be made from all three pots.

5.Service Reduction on Withdrawals: Withdrawing from the savings pot results in a reduction in years of pensionable service.

A member has 15 years of vested service, 4 months of savings service, and 8 months of retirement service, totaling 16 years of pensionable service. With an actuarial interest of R873,000, the member decides to withdraw R18,150 from the savings pot. After this withdrawal, the member loses 4 months of service, reducing their pensionable service to 15 years and 8 months. Their actuarial interest drops to R854,850. While this withdrawal gives the member quick access to cash, it also reduces their future pension benefits.

The Bigger Picture for GEPF Members

The two-pot system introduces a blend of flexibility and security for GEPF members, allowing for emergency access to savings while safeguarding their long-term retirement prospects. However, the key to navigating this new landscape lies in understanding the nuanced implications, the operational adjustments required, and the importance of making well-informed financial decisions.

For GEPF members, staying updated through official channels and seeking guidance tailored to their specific circumstances is paramount. You need to contact the fund directly if you want to make a withdrawal from your savings pot.

Steven Hall

Steven Hall is the Founding Partner at Henceforward. He is a CERTIFIED FINANCIAL PLANNER with over 20 years experience. Helping his clients navigate changes in legislation to ensure their retirement planning remains on track is extremely important to him.