Last Updated on 07/08/2025 by Carl-Peter Lehmann

In an increasingly interconnected world, offshore investing has become a cornerstone strategy for South Africans seeking to protect and grow their wealth. In 2025, the landscape of offshore investing is evolving, influenced by global economic shifts, regulatory changes, and emerging investment opportunities. This guide explores everything you need to know about offshore investing in 2025, providing actionable insights (including some of the best offshore investment opportunities) and strategies tailored for South African investors.

The Power of Offshore Investing: Why It Matters for South Africans

1. Diversification Beyond Borders

South Africa’s economy is a fraction of the global market, and while many JSE-listed companies earn revenue internationally, local investors remain limited in scope. Offshore investing spreads your risk across different economies and sectors, ensuring your portfolio isn’t tied to the fortunes of a single market. Simply put, gaining access to a broader investment universe is a smarter long-term strategy.

2. Hedging Against Rand Depreciation

The Rand’s long-term devaluation is undeniable. In 1993, R3.50 bought you a US dollar; today, it takes nearly R19.00. That’s an average decline of 5-6% per year, steadily eroding South Africans’ global purchasing power. Offshore investing preserves and grows your wealth in stronger currencies, protecting you from the relentless devaluation of the Rand.

3. Access to High-Growth Sectors and Markets

Investing offshore means tapping into the world’s most dynamic markets – like the US and Asia (with pockets in Europe and elsewhere)- where innovation drives future growth. Key industries such as technology, life sciences, and automation thrive in these regions, offering opportunities that the JSE simply cannot match. Limiting investments to South Africa means missing out on these game-changing sectors.

4. Positioning for Future Growth, Not Just Looking Back

While the JSE has historically delivered strong returns, the landscape has changed (even as we’ve seen better domestic returns of late). Economic drivers of the past won’t necessarily fuel future growth. Investing solely because South African assets seem “cheap” is risky – things are often cheap for a reason. Offshore investing gives you exposure to industries and regions poised for sustainable, long-term expansion.

5. A Global Lifestyle Demands a Global Portfolio

We live in a borderless world where work, travel, and lifestyle flexibility are the norm. Holding part of your wealth in hard currencies like USD or EUR makes international mobility and spending far easier. Whether it’s avoiding painful exchange rate conversions or planning a potential move abroad, an offshore portfolio provides financial freedom and security in an increasingly globalized world.

The Ease of Offshore Investing: Navigating the Regulatory Landscape

SARS has streamlined the process of obtaining tax clearance for offshore investments, making it easier and faster for South Africans to move funds abroad. Investors now use an online platform to apply for tax compliance status, often referred to as a “Tax Compliance Status (TCS) PIN.” This digital system ensures transparency and efficiency, allowing individuals to securely share their TCS PIN with financial institutions when required.

Annual Allowances

The South African Reserve Bank (SARB) allows individuals to invest offshore using their annual discretionary allowance (R1 million) and foreign investment allowance (R10 million, subject to tax clearance). Staying informed about these allowances ensures compliance while maximizing your offshore exposure.

Understanding the Tax Differences: Direct Offshore Investments vs. Rand-Based Offshore Funds

When investing offshore, the tax treatment of capital gains tax (CGT) is a key differentiator between direct offshore investments and Rand-based offshore funds.

1. Rand-Based Offshore Funds (Feeder Funds): Since these funds are priced in Rands, any gains or losses are calculated in Rand terms, meaning currency movements have a material impact on your CGT liability. Even if the underlying offshore investment has not gained in USD or other foreign currency terms, a depreciation of the Rand against the investment currency can create a taxable gain when you sell. This can lead to investors paying tax on currency depreciation rather than actual investment growth.

2. Direct Offshore Investments: When investing directly in foreign-domiciled assets (where money is physically moved offshore), capital gains are calculated in the investment’s base currency (e.g., USD, GBP, or EUR). This means currency fluctuations do not impact CGT directly, as tax is only paid on actual gains (or losses) in the foreign currency. However, any Rand weakness at the time of selling and repatriating funds can still affect the net proceeds when converted back into Rands.

Additionally, foreign withholding tax on dividends and estate (situs) tax in certain jurisdictions (e.g., US and UK) may apply when investing directly offshore. On the other hand, Rand-based offshore funds are structured as local unit trusts and do not expose investors to foreign estate taxes, but often come with higher fees and less control over currency conversion timing.

Deciding between direct offshore vs. Rand-based offshore investments requires careful consideration of CGT impact, tax efficiency, estate planning, and long-term investment objectives.

Offshore Investment Options: Finding the Right Fit for You

Investing offshore is easier than most people think, and there are multiple ways to do it – whether you’re a hands-on investor or prefer professional management. Here are some of the most effective ways South Africans can gain offshore exposure:

1. DIY Brokerage Accounts – Low Cost, Maximum Control

For investors who like to take control, a DIY brokerage account offers the flexibility to buy shares, ETFs, and other instruments. With numerous platforms available, Interactive Brokers and Easy Equities stand out as a top choice due to their competitive fees, global market access, and strong reputation. DIY investing is the most cost-effective option, and you can start with relatively small amounts. However, it requires a solid understanding of markets and investment strategies, making it best suited to those comfortable making their own decisions.

2. Professionally Managed Unit Trust Funds – A Hands-Off Approach

If you prefer expert guidance, professionally managed offshore unit trusts are an excellent option. Reputable platforms such as Ninety One, Allan Gray, Momentum International, and Glacier International offer a wide range of offshore funds. The key challenge? Choosing the right funds from hundreds of available options. This is where professional advice becomes crucial- helping align your investments with your goals, risk tolerance, and time horizon.

3. Direct Share Portfolios – Tailored Investments for High-Net-Worth Individuals

For those with a larger capital base (typically USD 250,000+), a direct share portfolio allows for a customized, actively managed investment strategy. This gives you access to global markets with a portfolio manager who builds a diversified mix of individual stocks tailored to your needs. If you prefer a hands-on relationship with an investment professional, this can be a great way to gain personalized offshore exposure. We work with three to four trusted providers in this space, depending on client needs.

4. Monthly Debit Order Options – Building Offshore Wealth Consistently

Some providers now offer automated monthly debit orders, where your Rands are converted into foreign currency and invested in offshore funds regularly. A minimum of R10,000 per month is typically required, making it an attractive way to build offshore exposure consistently without needing to commit a lump sum upfront.

The Right Offshore Investment for You?

There’s no one-size-fits-all approach – your offshore investment strategy should align with your financial goals, risk appetite, and level of involvement. Whether you’re looking for low-cost DIY options, expert-managed funds, or customized global portfolios, the key is to get started and make offshore investing a part of your long-term financial plan.

Structuring Offshore Investments: Protecting and Transferring Wealth Efficiently

As your wealth grows, how you structure your offshore investments becomes just as important as where you invest. Smart structuring can help minimize taxes, avoid foreign probate, reduce executor’s fees, and streamline intergenerational wealth transfer.

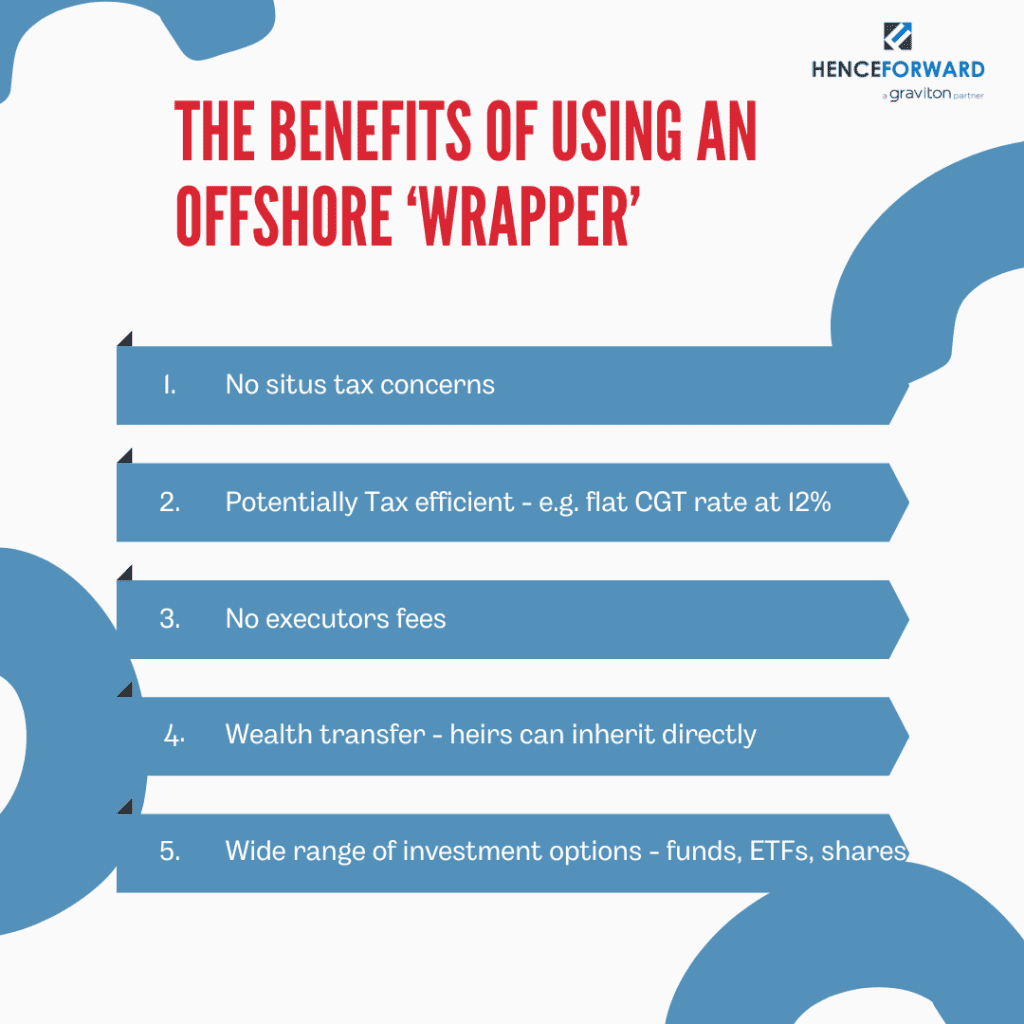

Offshore Endowments & Life Wrappers: Ideal for USD 100K+

For investors with offshore assets exceeding USD 100,000, an offshore endowment or life wrapper offers significant advantages. These structures provide:

- Tax efficiency – Potentially lower tax rates on investment growth.

- Estate planning benefits – Avoid foreign probate and simplify inheritance.

- Creditor protection – Depending on jurisdiction, assets may be shielded from creditors.

Offshore Trusts: A Solution for USD 1-2 Million+

For those with USD 1-2 million or more in offshore assets, an offshore trust could become a valuable tool. Trusts allow for greater control over wealth distribution, ensuring that assets are managed and transferred according to your wishes. They offer:

- Long-term wealth preservation – Protecting assets for future generations.

- Estate duty savings – Potential reductions in estate taxes and executor fees.

- Asset protection – Mitigating risks from legal claims or creditor exposure.

Further Reading: The Benefits of Discretionary Trusts as Wealth Transfer Tools

By choosing the right structures, you can ensure your offshore wealth is efficiently managed, protected, and passed on seamlessly to the next generation.

Amongst The Best and Top-Performing USD Offshore Funds for South African Investors Currently

For an offshore fund from a foreign asset manager to be available to South African investors, it needs to be S65 approved by the Financial Sector Conduct Authority (FSCA). This approval process ensures that the fund meets certain regulatory standards, but it also means that as retail investors, we are limited to investing only in offshore funds that have received this approval – restricting access to some global investment options that might be available to institutional investors.

Below are some of the best performing US Dollar denominated offshore funds currently available to South African offshore investors that are available across various offshore platforms like Allan Gray Offshore, OMI, Glacier International and Ninety One Offshore. Returns as at 30/06/2025. As a reference the iShares Core MSCI World ETF returned 14.63% p.a.

| Rank | Fund Name | 5-Year Annualised Return (USD %) | Style / Commentary |

|---|---|---|---|

| 1 | Contrarius Global Equity | 27.50% | High conviction, contrarian value strategy. Heavy concentration, often in energy and materials. |

| 2 | Ranmore Global Equity | 21.70% | Valuation-aware global equity fund with a bias toward quality and mid-cap names. |

| 3 | PSG Global Equity | 18.33% | SA-managed global equity fund with a flexible, valuation-driven approach. |

| 4 | iShares Nasdaq 100 UCITS ETF | 17.85% | Passive exposure to tech-heavy Nasdaq 100. Captures growth in US mega-caps. |

| 5 | Janus Henderson Global Tech Leaders | 17.77% | Actively managed global tech fund focusing on leading tech innovators. |

| 6 | Artisan Global Value | 16.73% | Quality value manager with a global remit and strong capital preservation mindset. |

| 7 | Jupiter Merian World Equity | 16.54% | Blend of quality and thematic growth, includes innovation-focused holdings. |

| 8 | Dodge and Cox US Stock | 16.42% | Classic deep value US equity fund, large-cap focused, contrarian style. |

| 9 | iShares Core S&P 500 UCITS ETF | 16.31% | Low-cost US equity exposure, broad-based and consistent performer. |

| 10 | Orbis Global Balanced | 16.00% | Balanced multi-asset strategy with flexible asset allocation and strong downside protection. |

| 11 | Schroders ISF Global Recovery | 15.96% | Recovery-focused value fund, targets companies trading below intrinsic value. |

Further Reading: Look at How This Compares to the Best Performing Rand-Denominated Offshore Unit Trust Funds

Building Offshore Portfolios: A Smart Blend of Active Management, ETFs, and Tax Efficiency

When constructing offshore portfolios for clients, we take a holistic and tailored approach, ensuring that investments align with each client’s return objectives, risk tolerance, and long-term financial goals. Our strategy blends some of the best actively managed funds … which offer strong alpha potential and skilled management … with cost-efficient ETF solutions to optimize diversification, liquidity, and cost control. Where possible, we leverage our institutional relationships to access offshore funds that are not S65 approved, providing clients with a broader and more sophisticated investment universe beyond retail constraints. In addition to investment selection, we prioritize tax-efficient structuring, using offshore wrappers and structures to mitigate issues such as situs tax, executors fees, and tax efficiency, ensuring that wealth is protected, optimized, and smoothly transferred across generations.

Read Next: AI and Investing and some of the exciting investment opportunities in this space.

Conclusion

Over the past three decades, the South African Rand has steadily depreciated against the US Dollar, with an average annual decline of around 5.9%. While short-term fluctuations may see temporary strengthening, the long-term trend remains clear – wealth held solely in Rands continues to lose global purchasing power. Offshore investing is not just about chasing returns; it’s about financial security, diversification, and protecting your hard-earned wealth from local economic and currency risks. By incorporating offshore investments into your portfolio, you gain access to a broader range of global opportunities, ensuring your wealth is positioned for long-term growth and resilience. If building true financial security is your goal, offshore investing must be a core component of your strategy.

Disclaimer:

As with any investment, thorough research and professional guidance are essential. Consider consulting a qualified financial planner or wealth manager to ensure your offshore investments align with your financial objectives and risk tolerance.

Carl-Peter Lehmann

Carl-Peter, CFP® is a director at Henceforward, a specialist wealth management and family office firm. With over 20 years of experience in financial planning and investment management, he has spent much of his career focused on the offshore investment arena, including time in global financial centres. Carl-Peter helps high-net-worth individuals structure globally diversified portfolios aligned with their long-term goals, with a focus on tax efficiency, risk management, and access to top-tier asset managers worldwide.