Last Updated on 27/10/2025 by Carl-Peter Lehmann

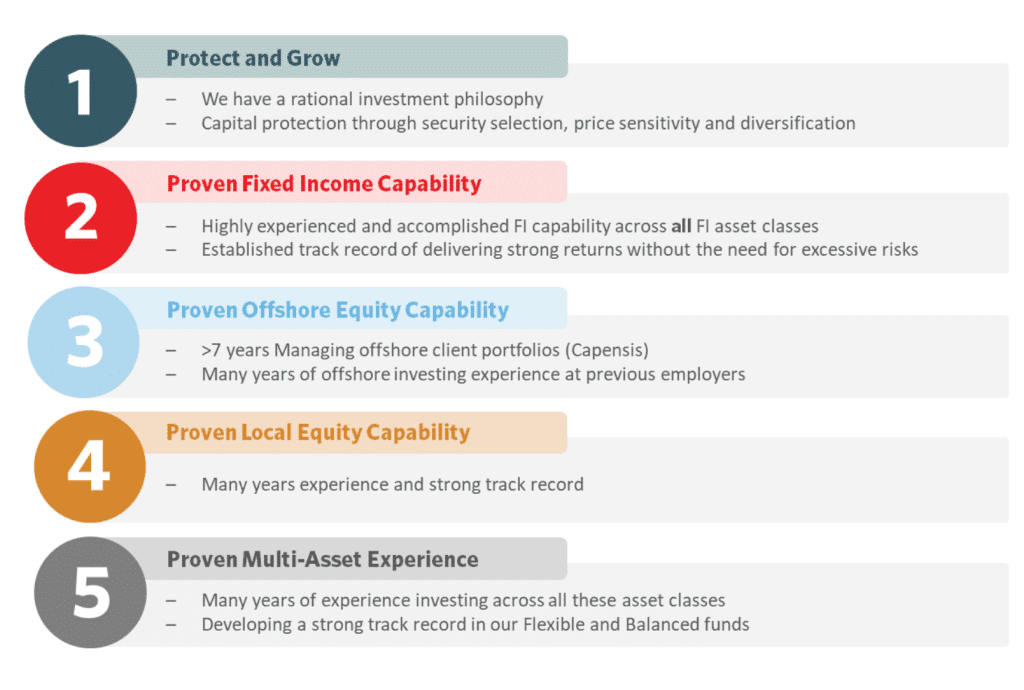

At Henceforward, we’re drawn to investment managers who do things a little differently … those who combine humility with conviction, who quietly build a track record based on process rather than prediction. One of those firms is Granate Asset Management, a boutique South African manager with a remarkably consistent record across its Balanced, Flexible, and Multi-Income funds.

We recently sat down with the Granate team to unpack their philosophy, how they think about risk, and where they see opportunity in a world that’s moving faster than ever. What emerged is a fascinating look inside a firm built on discipline, alignment, and a singular purpose: to protect and grow client capital.

A Singular Investment Philosophy

When asked what ties their strategies together, the team didn’t hesitate.

“Granate has a singular investment philosophy that we apply to all savings entrusted to us,” they explained. “We believe that markets are inefficient, and asset prices often don’t offer accurate risk compensation.”

That inefficiency, they argue, creates opportunity … not just in cheap “value” shares, but also in quality growth companies that can compound earnings for years. The key, though, is separating business quality from valuation.

“We won’t buy something simply because it looks cheap. We first ensure it’s a sound investment — that it’s unlikely to greatly disappoint — and only then do we consider price.”

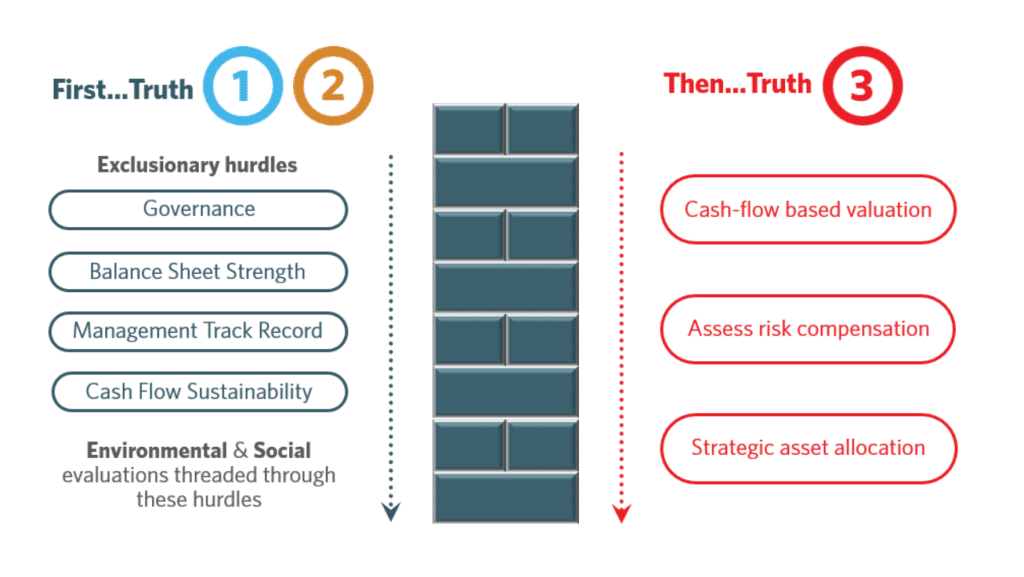

This two-stage process ensures they don’t fall into the trap of chasing bargains that are cheap for a reason. Instead, Granate focuses on where the odds of good outcomes are highest, analysing every business through four qualitative lenses: governance, balance-sheet strength, management track record, and cash-flow sustainability.

Their framework is grounded in three timeless market truths:

Many companies will fail.

Some will compound value for decades.

Emotions in markets create mispricing.

Granate’s job, as they see it, is to tilt the odds toward the second group — while managing the emotional noise of the third.

Culture as the Real Edge

Many managers speak of “discipline” and “consistency.” Granate goes further.

“We don’t compare ourselves to competitors – that would distract us from our purpose,” they said. “Watching peers could make us follow the herd and fail to offer clients something uniquely good.”

That quiet confidence defines their culture. Every member of the team is aligned around a single purpose … protecting and growing client savings. Their edge, they believe, lies as much in culture as in process.

“We have a sound philosophy built on favourable odds. Our culture determines how thoroughly we work and how well we execute.”

It’s also why the team invests alongside their clients – a sign that conviction isn’t theoretical.

A Thoughtful View on Risk

Granate defines risk differently from most. It isn’t volatility or deviation from benchmarks. It’s the failure to deliver the returns clients need.

“Volatility is the price you pay for superior returns over a cycle,” they said. “Avoiding mistakes significantly improves long-term outcomes.”

Rather than chase what’s popular, they assess whether the price of any asset adequately compensates for uncertainty. They manage risk both at a security level and across the portfolio – monitoring concentrations, correlations, and ensuring diversification across industries and geographies.

In other words: risk management isn’t a line item in their process; it is the process.

Positioning in an Uncertain World

With inflation still sticky and global growth uneven, Granate’s asset allocation blends macro awareness with bottom-up conviction.

“Our positioning is informed by where we find compelling opportunities, the macro backdrop, diversification, and the return objective we need to achieve,” they explained.

This multi-faceted approach – balancing top-down and bottom-up analysis – aims to maximise the odds of hitting each fund’s return target (CPI + 6% for Flexible, CPI + 5% for Balanced).

That means being willing to look very different from peers.

“When we find new ideas or our opinions change, we implement swiftly,” the team said. “Our portfolios may look nothing like others — and performance will too.”

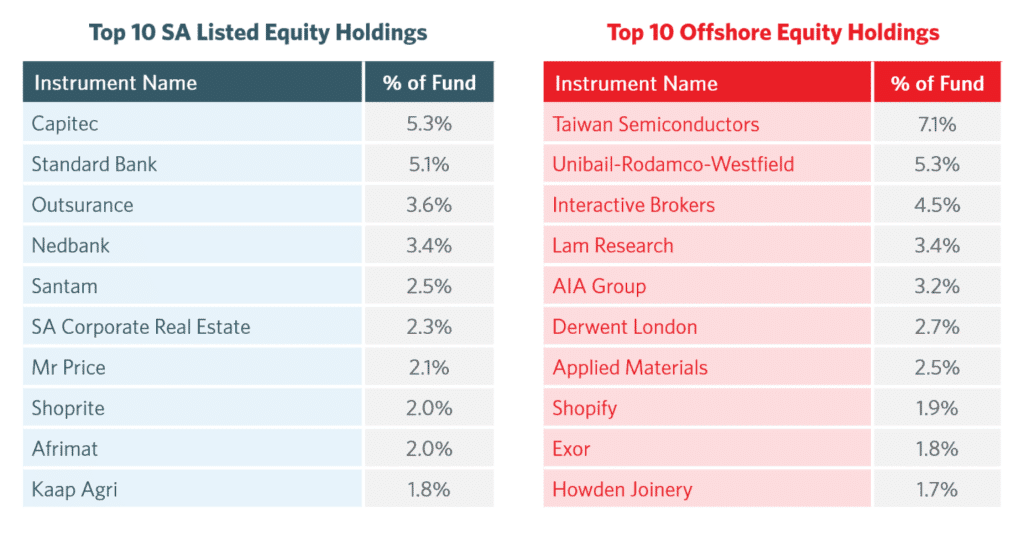

Recent portfolio shifts illustrate that discipline in action. Granate exited Growthpoint, British American Tobacco, Berkshire Hathaway, and Markel Group — largely for valuation reasons. Meanwhile, they increased exposure to Standard Bank, Outsurance, and Interactive Brokers, where they believe markets underappreciate quality.

They’ve also added a handful of offshore names — Disco Corporation, Hong Kong Stock Exchange, Kweichow Moutai, Keyence, MercadoLibre, and Shopify — each small but high-potential positions that could grow as conviction builds.

The Understated Success of the Multi-Income Fund

While Granate’s equity-oriented funds often attract the spotlight, their Multi-Income Fund quietly celebrates its tenth anniversary next year — and has outperformed its cash benchmark by 2.5% p.a. after fees since inception.

“The strategy builds a multi-scenario portfolio designed to harvest returns across the entire fixed-income opportunity set,” they explained.

That includes credit, yield enhancement, and selective use of duration — but never as a binary bet. Flexibility, liquidity, and a deep understanding of credit markets underpin every decision. The focus, again, is risk-adjusted returns, not yield for yield’s sake.

In a market where many investors overlook income funds, Granate has turned consistency into quiet excellence.

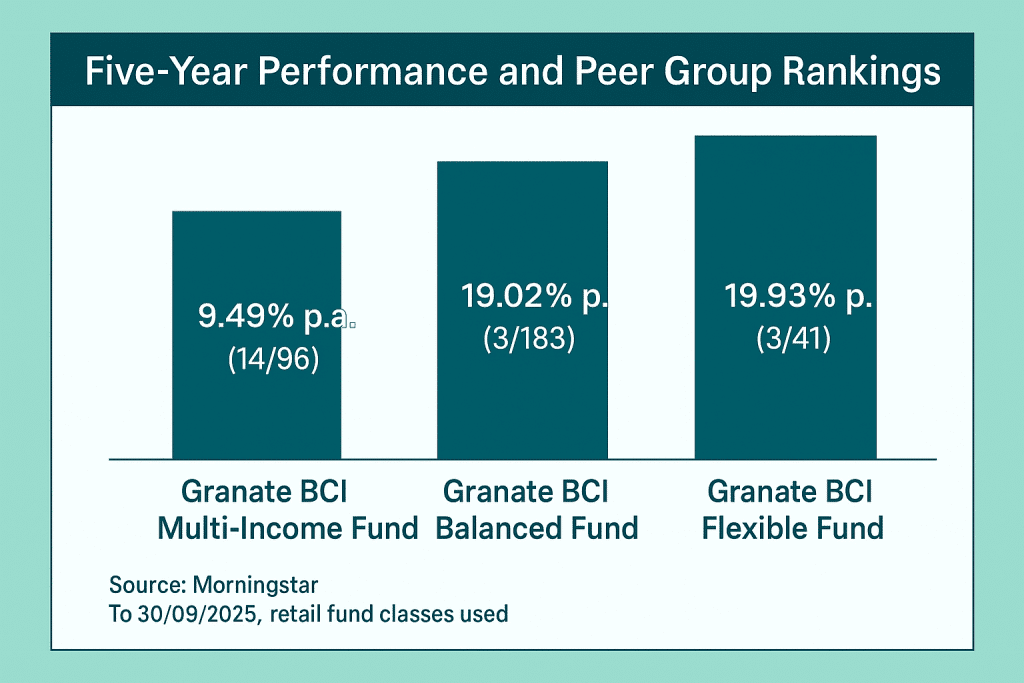

The performance of Granate Asset Management's funds relative to peers

Over the past five years, Granate Asset Management has delivered standout results across its range of funds. The Granate BCI Flexible Fund ranks 3rd out of 41 peers with a return of 19.93%, closely followed by the Balanced Fund at 19.02% (3rd of 183). Even the more conservative Multi-Income Fund achieved an impressive 9.49%, placing it 14th out of 96. Together, these results underscore Granate’s disciplined, client-focused approach and ability to generate strong, risk-adjusted returns across market cycles.

Now Read: How we rate and rank South Africa’s top asset management companies.

On AI, Bubbles, and What’s Being Overlooked

Talk inevitably turned to bubbles — particularly in artificial intelligence stocks. The team’s take was refreshingly balanced.

“It’s hard to argue that all AI-related stocks are in bubble territory,” they said. “Some companies may be pricing in unrealistic prospects, but our semiconductor holdings are still at reasonable valuations.”

Closer to home, they see tremendous value on the JSE, especially in the large banks like Standard Bank and Nedbank, as well as property across South Africa, the EU, and the UK.

For long-term investors, those overlooked areas could hold the most opportunity.

Lessons for Everyday Investors

Asked for one piece of timeless advice, the answer was simple:

“Invest in great companies for the long term rather than trying to time share prices.”

Granate doesn’t block out market noise — they use it.

“We test counter-views to challenge our own thinking. FOMO is avoided by focusing on sustainable competitive advantages and reassessing them continuously.”

It’s a refreshing mindset in an age of daily data and constant distraction.

Further Reading: South Africa’s best performing equity funds over 3, 5, and 10 years

Stories That Shape Thinking

Every investor has stories that leave a mark. For Granate, Capitec is one of them.

“We’ve followed Capitec very closely. Their low-cost model allowed them to take market share for two decades — it’s been a big win.”

That story reinforced their belief in structural advantage – finding businesses that can keep compounding because they genuinely do something better than their competitors.

Looking Ahead

So, what excites them — and what keeps them up at night?

“We’re optimistic about South Africa’s prospects. If the economy grows, there’s tremendous upside in JSE-listed companies,” they said. “But we’re always watchful — investors can’t afford to be fooled by political noise.”

Globally, they’re focused on how technology, including AI, could disrupt business moats.

“The next decade will challenge many assumptions. Staying awake to technological change will be critical.”

Final Thoughts

In a world obsessed with short-term performance, Granate’s philosophy feels refreshingly timeless. They’re not chasing trends, benchmarks, or bragging rights. They’re stacking the odds — quietly, methodically, and with deep respect for risk and process.

At Henceforward, we share that belief: that true investing isn’t about predicting markets, but about aligning discipline with purpose.

Granate Asset Management may not make the loudest noise in the room — but they’re exactly the kind of manager you want in your corner when markets test your patience and conviction.

For full disclosure, Henceforward uses several of Granate Asset Management’s funds within our model portfolios, reflecting our conviction in their disciplined process, long-term philosophy, and consistent track record of delivering strong risk-adjusted returns.

Further reading: Check out our interview with David Hansford from Long Beach Capital who manages one of South Africa’s best balanced funds

Carl-Peter lehmann

Carl-Peter is a Certified Financial Planner (CFP®) and Director of Henceforward, a South African boutique wealth management firm. With over 20 years of experience in wealth management - including extensive expertise in offshore investing - Carl-Peter focuses on building evidence-based, diversified portfolios aligned with clients’ long-term goals.