Last Updated on 24/10/2025 by Carl-Peter Lehmann

Gold Investment 2025? Gold is the talk of the town … and the gold-bugs are positively ecstatic. After years of sluggish returns, the yellow metal has exploded higher over the last 2 years, leaving even seasoned investors in awe.

But what’s really driving gold’s incredible run? And should you be joining the rush? In this piece, we unpack the forces behind gold’s resurgence – from central bank buying to fiscal debasement – and why, despite the shine, we’d urge caution. Because as history reminds us, the time to get excited about gold is usually before everyone else is talking about it.

The New Gold Rush: Confidence and Control

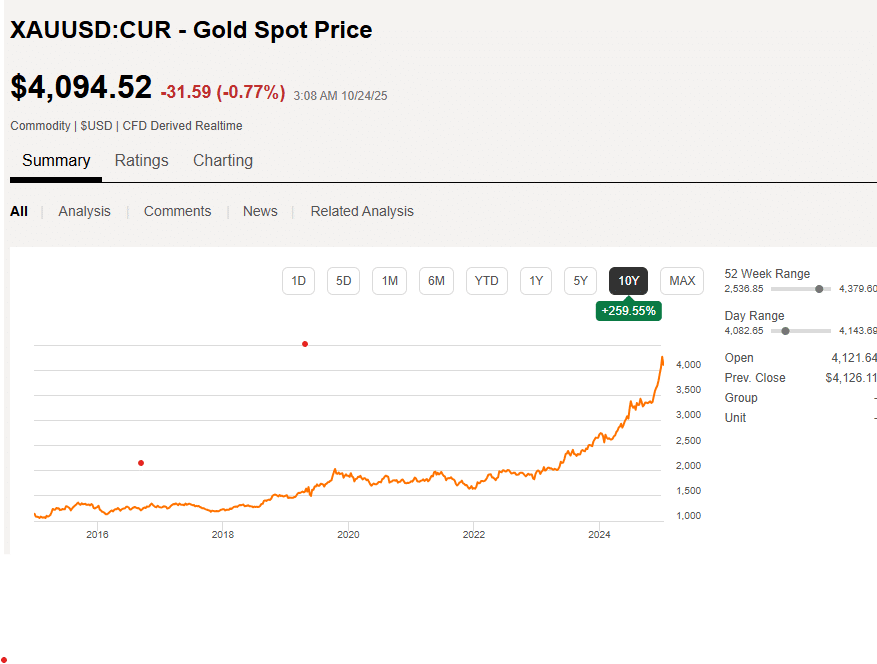

If you blinked at the start of 2025, you probably missed one of the fastest ever USD 1,000 moves in the gold price. Gold burst through USD 3,000/oz earlier this year and raced toward USD 4,000 – a 150% surge since mid-2022. This isn’t a speculative blip. It’s a confidence crisis playing out in real time. Until recently, gold was a sideshow in global markets. Now it’s centre stage again … a symbol of trust, sovereignty, and control.

The Weaponisation of the Dollar

When the U.S. and its allies froze USD 300 bn of Russia’s reserves in 2022, reserve managers worldwide asked a sobering question: “Are my dollars really mine?”

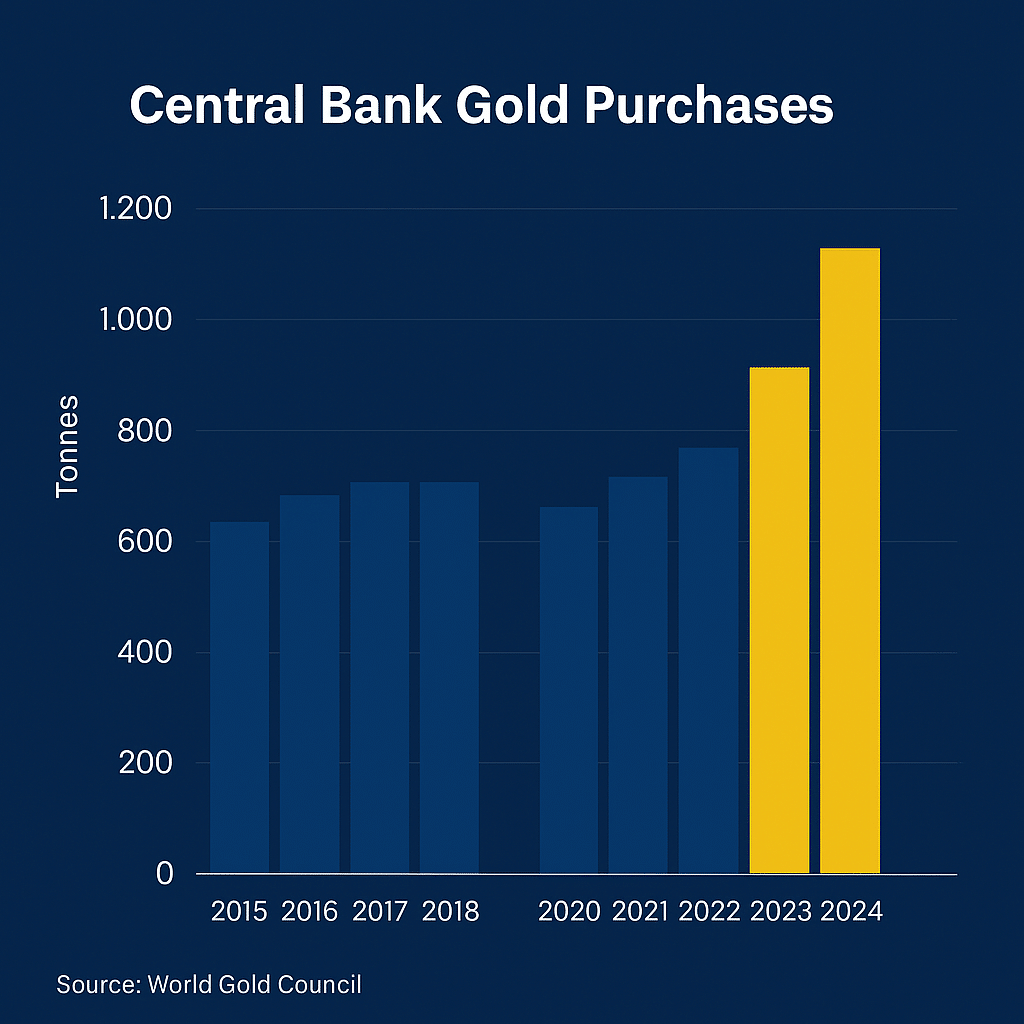

Emerging-market central banks have been acting ever since. Official gold buying averaged 85 tonnes per month in 2024 – five times the pre-2022 norm.

Even a 5% rotation of global FX reserves (USD 12 trn) into bullion would equal six years of mine supply. In a small market (~USD 10 trn), that’s explosive.

As Matrix Fund Managers’ Lourens Pretorius and Sollie van der Linde noted in an enlightening piece recently, “The age-old question of ‘Are my dollars really mine?’ suddenly had a very uncomfortable answer.”

The “Debasement Trade” and Fiscal Fatigue

Geopolitics may have lit the spark, but fiscal policy poured on the fuel. The U.S. is running budget deficits exceeding USD 1 trn per year, even in a period of economic expansion. Debt-to-GDP ratios are at post-war highs, and interest costs are now the fastest-growing item in the federal budget.

For investors, this fuels what traders call the “debasement trade” … the expectation that the real value of fiat money will erode over time. When real yields turn negative, the opportunity cost of holding gold disappears. Gold’s lack of yield becomes a feature, not a flaw.

From Central Banks to Costco: Democratized Demand

This bull market spans institutions and retail alike. ETF inflows have returned after two years of outflows, Chinese insurers can now hold bullion, and Costco sells roughly USD 1 million of gold coins every two hours. In Indonesia, vending machines dispense one-gram gold wafers like snacks. The world’s oldest store of value has gone viral.

Supply Can’t Keep Up

Mining new gold isn’t like printing new dollars. Projects take years, grades are falling, and exploration budgets are tight. Wood Mackenzie puts the industry cost curve near USD 1,960/oz, leaving little room for expansion. Most producers are using profits to pay dividends rather than build new mines – ensuring supply remains tight.

The Dollar’s Slow Drift, Not Collapse

The USD still anchors 88% of FX trades and 58% of global reserves … but that share has slid from 72% in 2000. This is not a crash, it’s a quiet diversification. Each marginal reserve dollar redirected into bullion, yuan, or euros weakens automatic demand for Treasuries … and strengthens gold’s bid.

A South African Perspective

For local investors, gold’s rally has had a very tangible impact …

Much of the JSE’s performance this year has been driven by resource companies, with gold and platinum miners delivering stellar returns. Specialist resource funds have enjoyed exceptional gains, benefitting from both the surge in commodity prices and renewed investor interest in hard assets.

The rally in gold has also been a contributing factor to the rand’s relative resilience, helping offset some of the headwinds from weak local growth and fiscal pressures.

However, this strength also comes with a warning. Just as the U.S. equity market has become increasingly concentrated in a handful of tech giants, South Africa’s market has become heavily reliant on resource shares for performance. This introduces its own concentration risk, making it even more important for investors to understand how well their portfolios are truly diversified.

Rand-denominated exposure via NewGold ETF or even good-old Krugerrands has outpaced inflation and most equity benchmarks handsomely, while local miners such as AngloGold Ashanti and Harmony have seen profits soar. But as always, balance matters … the goal isn’t just to ride one wave but to ensure your broader wealth strategy can withstand the next tide.

Now Read: The best performing funds in the South African unit trust space

Gold’s Place in a Modern Portfolio

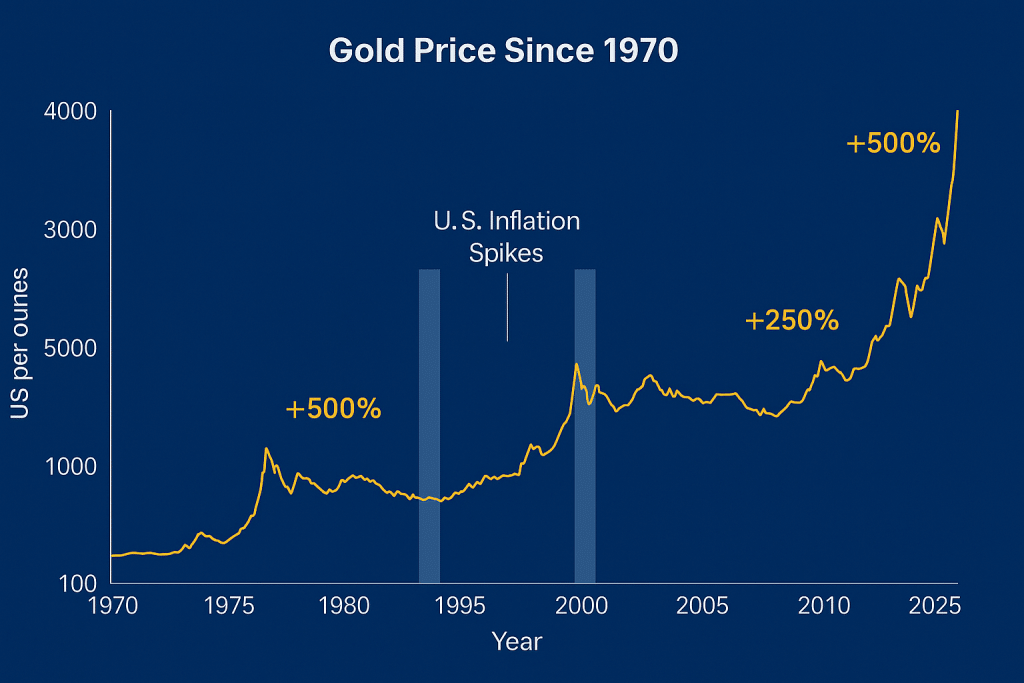

While gold has historically provided valuable diversification benefits, its effectiveness as a hedge is far from consistent. It tends to perform best during periods of financial stress, negative real yields, or geopolitical turmoil … such as the 1970s inflation era, the Global Financial Crisis, and the pandemic years … when confidence in fiat money wavers and investors seek stability.

However, it has also gone through long stretches of disappointment, notably from the 1980s through the late 1990s, when disinflation, rising real yields, and booming equity markets eroded its appeal, and again during much of the QE era when liquidity suppressed volatility. In short, gold is not a perfect hedge but a strategic insurance asset – one that can protect portfolios from tail risks and monetary disorder, but not necessarily from every market downturn.

Hence, keeping a modest, balanced allocation makes more sense than betting heavily on it, especially late in a bull cycle like the current one.

Now Read: Unpacking the various forms of investment risk in more detail

A Note of Caution

With the parabolic moves we’ve seen in gold of late, a note of caution is warranted. The time to go long gold was three years ago, not today.

While the metal could certainly go higher, we would caution against adding meaningful new allocations at this stage. Momentum-driven assets can overshoot, and gold is no exception.

The chart below shows how gold has effectively been in a bull market for the past decade, even if its most explosive moves have come only in the last two years. These kinds of near-vertical, parabolic surges often mark the final stages of a cycle, rather than its beginning – and we wouldn’t be surprised if 2026 proves to be the year this bull run ends.

As we often remind clients, cycles tend to die in euphoria, not despair.

Even seasoned investors like Ray Dalio have suggested that a 15% allocation to gold can make sense, but for most investors, that’s extremely high. Gold should remain a strategic hedge, not a core holding.

From our perspective, the time to add meaningfully to gold holdings would likely be after the next major bear market, when sentiment turns against it again. Of course, we could be wrong – but based on history and market psychology, we believe we’re closer to the end than the beginning of this gold bull cycle.

As always, prudence, diversification, and discipline matter more than chasing any single asset’s performance, no matter how shiny it looks.

Conclusion: A Confidence Story

Gold’s resurgence isn’t about nostalgia or doomsday. It’s about trust – or rather, the slow erosion of it.

Every time the dollar weakens, every time deficits rise, and every time geopolitics fractures, reserve managers and investors alike reach the same conclusion: a little more gold can’t hurt.

As Matrix’s portfolio managers put it:

“The 21st-century gold story is ultimately a confidence story, and the world’s faith in unbacked fiat money appears shakier than at any time since 1971.”

In a world awash with paper promises, gold’s simplicity may once again be its greatest strength.

Carl-Peter Lehmann

Carl-Peter Lehmann, CFP®, is a director at Henceforward, a South African wealth and family office firm providing independent, flat-fee financial planning and investment advice. With over 20 years’ experience across global financial centres, Carl-Peter specialises in offshore investing, portfolio construction, and holistic wealth strategy for high-net-worth families and professionals. His writing focuses on helping investors make smarter, data-driven decisions by combining market insight with real-world perspective.