Last Updated on 25/09/2025 by Carl-Peter Lehmann

ETFs (Exchange-Traded Funds) have gone from niche products to mainstream investing tools in South Africa. With costs under pressure, strong offshore returns, and a growing awareness of diversification, more South Africans are asking: “Should I be in ETFs?” The short answer: yes, but with context. ETFs are powerful building blocks, but they aren’t a silver bullet. Let’s unpack how they work, where they fit, and the risks to keep in mind.

What is an ETF?

An ETF is a pooled investment vehicle that holds a basket of assets—such as shares, bonds, or commodities—and trades on an exchange like the JSE. This means investors get the diversification of a collective investment, with the liquidity and tradability of a share.

For example, a single purchase of an ETF might give you exposure to the 40 largest companies on the JSE, or to more than 1,500 global companies through an MSCI World ETF. That’s the power of pooling — instant diversification, without the cost and effort of buying each share individually.

ETFs vs Unit Trusts vs Direct Shares

ETFs often get compared with unit trusts and direct share ownership, since they all represent ways of investing in markets.

Compared to unit trusts, ETFs are generally cheaper and more transparent. Most ETFs are passively managed, meaning they track an index rather than paying a manager to select stocks. This cost difference is significant: South African ETFs often charge around 0.2–0.5% per year, while many active unit trusts charge 1–2% or more. ETFs are also more flexible in that they can be traded throughout the day on the JSE, whereas unit trusts price only once a day. That said, unit trusts can offer active insights, tactical positioning, and niche exposures that ETFs do not always provide.

Compared to holding individual shares, ETFs spread your risk across many companies, reducing the danger of a single stock imploding. They also save you the admin and brokerage costs of buying 20 or 30 separate counters. On the other hand, a skilled investor may occasionally find exceptional opportunities in direct shares that can outperform the broader market.

A practical example: in a Tax-Free Savings Account (TFSA), with annual contributions capped at R36,000 and a lifetime limit of R500,000, ETFs are often the instrument of choice. A young professional putting R3,000 a month into a global equity ETF inside a TFSA could, over 20 years, build a rand-denominated offshore equity portfolio worth millions — without ever paying a cent in CGT or dividend tax.

Types of ETFs in South Africa

The South African ETF market has grown rapidly and now covers a wide range of exposures. Local equity ETFs track indices such as the FTSE/JSE Top 40, while global equity ETFs like the Sygnia Itrix S&P 500 or Satrix MSCI World allow investors to access offshore markets without moving money abroad. Bond and cash ETFs provide lower-risk options, while factor and smart beta ETFs tilt exposure toward themes like dividends, quality, or low volatility. Thematic ETFs, which focus on areas such as clean energy or technology, are still limited locally but are widely available offshore.

Why Aren’t Fund Managers Using More ETFs

If ETFs are so cost-effective, why don’t institutional managers use them exclusively? The answer lies in how mandates, revenue models, and liquidity work in practice.

Many South African retirement funds operate under Regulation 28, which requires certain exposures and often leans towards unit trust structures. Unit trusts also offer fund managers more flexibility to customise exposures, while ETFs are “off the shelf.” There’s also the commercial reality: managers earn their fees from assets they actively manage, and outsourcing large portions of portfolios to ETFs compresses their margins.

This doesn’t mean professionals ignore ETFs. They are widely used as tactical building blocks, particularly for gaining quick and cost-effective exposure to broad markets. But most managers prefer a blended approach, layering ETFs with active funds to meet mandates, liquidity needs, and investment views.

Factor Harvesting and ETFs

Not all ETFs are created equal. Factor harvesting, often associated with “smart beta” ETFs, is an investment strategy that aims to capture specific drivers of return—known as factors—that academic research has shown can outperform the broader market over time. These factors are characteristics or attributes of stocks that historically correlate with higher returns or lower risk. Unlike traditional ETFs that passively track a broad market index (e.g., JSE

Top 40 or S&P 500), factor ETFs apply rules-based strategies to “tilt” their holdings toward stocks exhibiting these characteristics.

Key Factors in Factor Harvesting

The most well-researched factors include:

1. Value: Investing in stocks that are undervalued relative to their fundamentals, like earnings or book value (e.g., low price-to-earnings or price-to-book ratios). These stocks are often “cheap” compared to their intrinsic value.

2. Momentum: Targeting stocks with strong recent price performance, as research shows stocks that have risen tend to continue rising in the short term.

3. Quality: Focusing on companies with strong financials, such as high profitability, stable earnings, or robust balance sheets.

4. Size: Investing in smaller companies, which historically have higher returns (and higher risk) than larger ones, known as the “small-cap premium.”

5. Low Volatility: Selecting stocks with historically stable prices, which can reduce portfolio risk and sometimes outperform in turbulent markets.

6. Dividends: Prioritizing companies with high or consistent dividend payouts, appealing to income-focused investors

How Factor Harvesting Works

Factor ETFs use transparent, systematic rules to select or weight stocks based on one or more of these factors, rather than relying on a fund manager’s subjective decisions. For example:

· A Satrix DIVI ETF in South Africa might overweight companies with high dividend yields.

· A Satrix Momentum ETF selects stocks with strong price performance over the past 6–12 months.

· A Sygnia Dividend Aristocrats ETF focuses on companies with a consistent history of increasing dividends.

This approach sits between passive investing (tracking a broad index) and active investing (stock-picking by a manager). It’s “smart” because it leverages data-driven insights but remains rules-based, keeping costs lower than active funds (typically 0.3–0.6% vs. 1–2% for active unit trusts).

Why Use Factor Harvesting?

Enhanced Returns: Research, like the work of Fama and French, shows that factors like value and size can outperform broad markets over long periods.

2. Risk Management: Factors like low volatility or quality can reduce portfolio drawdowns during market stress.

3. Diversification: Combining multiple factors (e.g., value + momentum) can smooth returns, as factors perform differently in various market conditions.

4. Cost Efficiency: Factor ETFs are cheaper than actively managed funds, making them attractive for cost-conscious investors.

Example in South Africa

Imagine you invest in the Satrix Quality ETF. It selects JSE-listed companies with strong financial metrics (e.g., high return on equity, low debt). Over time, these companies may outperform the broader JSE Top 40 index if quality stocks lead the market, as they often do in uncertain economic climates. However, in a growth-driven bull market, a momentum ETF might outperform instead.

Risks and Considerations

· Cyclical Performance: Factors don’t always work simultaneously. Value may lag during tech-driven markets, while momentum can crash in reversals.

· Concentration Risk: Factor ETFs may overweight certain sectors (e.g., tech for momentum), reducing diversification.

· Costs: While cheaper than active funds, factor ETFs are often pricier than broad-market ETFs (e.g., 0.4% vs. 0.2% annually).

· Rand Volatility: For South African investors in offshore factor ETFs (e.g., a US quality ETF), currency swings can amplify or erode returns.

Practical Application

Factor harvesting shines in strategic portfolio construction. For example, a South African investor might:

· Use a Satrix MSCI World ETF for broad global exposure (core holding).

· Add a Satrix DIVI ETF for income and stability.

· Include a Sygnia Itrix S&P 500 Quality ETF for exposure to high-quality US firms. This mix balances broad-market returns with targeted factor exposures, potentially boosting returns or reducing risk.

In short, factor harvesting is about systematically capturing proven drivers of return to enhance a portfolio’s performance, while keeping costs low and maintaining transparency. It’s a powerful tool for South African investors, especially when paired with thoughtful asset allocation, but it requires understanding which factors suit your goals and market conditions.

When ETFs Perform Well (and When They Don’t)

ETFs excel in trending bull markets, where low costs and broad exposure allow them to beat the average active manager. They also shine in highly efficient markets, like US large caps, where stock-picking rarely delivers consistent alpha. For cost-sensitive portfolios, their fee advantage compounds significantly over time.

But ETFs can struggle in choppy or sideways markets where active managers can add value by holding cash or rotating sectors. They also carry concentration risk: the S&P 500, for example, is heavily weighted to the “Magnificent Seven” technology stocks. Investors in growth ETFs need to be mindful that they are not buying a perfectly balanced spread of 500 companies, but rather a market dominated by a few giants. If those falter, the ETF follows.

South Africans must also remember that rand moves matter. In March 2020, when the rand collapsed from R14 to nearly R19 to the dollar, investors in offshore ETFs actually saw positive returns in rand terms — even though US markets had fallen. In 2016, the opposite occurred: the rand strengthened, eroding dollar-based gains. ETFs don’t hedge this automatically, so investors carry the full impact of currency swings.

Looking Under the Hood: Overlap and Concentration Risk

Many investors assume that buying multiple ETFs automatically increases diversification. But when you look under the hood, that’s not always true.

Take an MSCI World ETF and a Nasdaq 100 ETF. On paper, they appear different. But drill into the holdings, and the same names dominate both: Apple, Microsoft, Amazon, and Nvidia. Instead of spreading risk, you may just be doubling your exposure to US mega-cap tech.

This creates hidden concentration risk. In recent years, the “Magnificent 7” drove a disproportionate share of US market returns. Owning multiple growth ETFs often just meant riding the same wave.

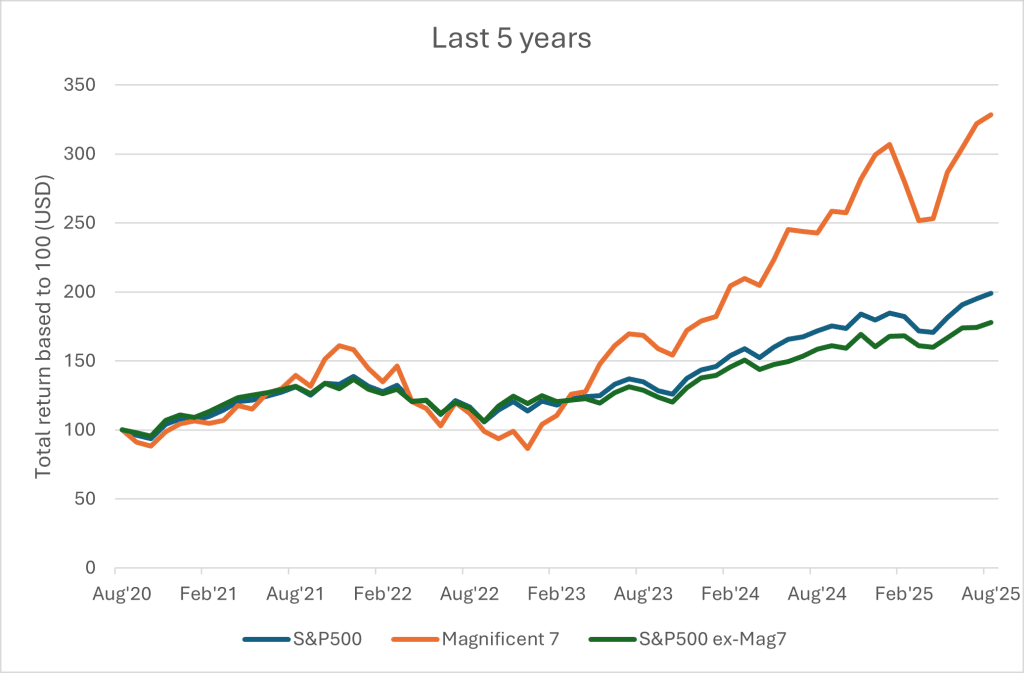

Impact of the Magnificent 7 on US Market Returns (2020-2025)

Here’s the illustration of the Magnificent 7 effect on US markets over the last five years:

- The Magnificent 7 (Apple, Microsoft, Amazon, Nvidia, Google, Meta, Tesla) delivered outsized gains, rising +228% over this period (more than tripling in value).

- The S&P 500 as a whole rose +99%, nearly doubling in value — with a large part of that growth driven by those same seven companies.

- The S&P 500 excluding the Magnificent 7 rose +78%, showing solid performance but lagging the full index.

This concentration means that owning broad US market ETFs — whether S&P 500, Nasdaq 100, or even MSCI World — often meant riding the same narrow group of companies. Many investors thought they were diversified, but in reality their portfolios hinged heavily on a handful of mega-cap tech names.

👉 A professional lens matters. At Henceforward, we go beyond the ETF label and analyse the actual holdings. That way, portfolios achieve genuine diversification — across sectors, geographies, and asset classes — rather than hidden overlap.

Further Reading: How to Invest Offshore as a South African with some of the best performing offshore funds

Are ETFs Fully Liquid?

ETFs trade on the JSE just like shares, meaning you can buy or sell them at market prices throughout the day. This makes them more flexible than unit trusts, which price once daily at their NAV.

However, practical liquidity depends on factors like bid–ask spreads, the size of the ETF, and the liquidity of its underlying holdings. Large funds like the Satrix Top 40 or Sygnia Itrix S&P 500 trade smoothly. Niche funds with smaller volumes may be less liquid, though authorised participants can always create or redeem ETF units to meet demand.

In short, ETFs give investors share-like liquidity with fund-like diversification, but friction costs (like wider spreads) may appear in smaller or less popular products.

Tax Considerations

For South Africans, ETF income and gains are taxed similarly to unit trusts. Dividends attract a 20% withholding tax, and capital gains tax (CGT) applies when units are sold at a profit. Offshore ETFs held directly can trigger foreign estate duty exposure, but most JSE-listed global ETFs avoid this complication. Wrappers, endowments, or trusts can also provide tax and estate planning advantages.

Platform Limitations: Why Some LISPs Don’t Offer ETFs

Despite their popularity, not all linked investment service providers (LISPs) make ETFs widely available. These platforms were originally designed around unit trusts under CISCA and often lack the stockbroking infrastructure to handle intraday trading. Their revenue models also rely on rebates from unit trusts, which ETFs don’t provide.

As a result, investors using LISPs may find themselves limited to curated menus that don’t include the full ETF universe. This is where independence matters. At Henceforward, we help clients access the right combination of ETFs, unit trusts, and structures — without being constrained by platform menus.

ETFs in Portfolio Strategy

ETFs are best seen as building blocks. A broad market ETF like the S&P 500 or MSCI World can serve as the growth core of a portfolio. Factor ETFs can tilt exposures toward value, momentum, or dividends. Bond ETFs can add stability and income. And money market ETFs can act as a liquidity reserve.

Used together, they provide the scaffolding for strategic asset allocation, which research shows is the single biggest driver of long-term returns.

Sequence of Return Risk: The Retiree’s Challenge

📌 Definition: Sequence of Return Risk

Sequence of return risk is the danger that the order of investment returns — not just the average — determines whether your retirement portfolio lasts.

- Negative returns early in retirement, when you are drawing an income, can permanently reduce your capital base.

- Even if the long-term average return is the same, a bad sequence at the start may cause your money to run out years earlier than if the good years had come first.

👉 In short: it’s not only how much your portfolio earns, but when it earns it.

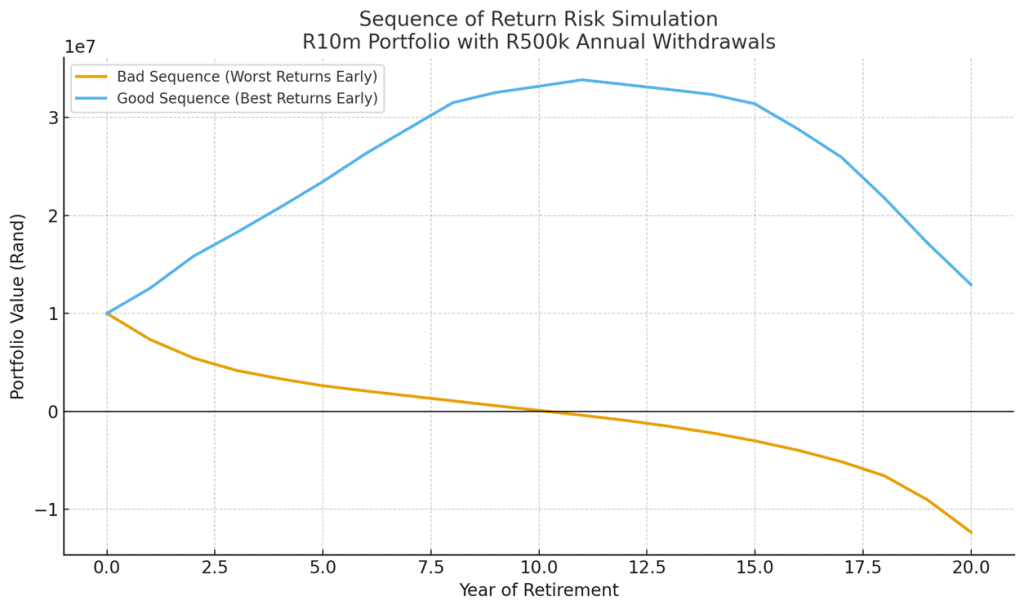

While ETFs are excellent for long-term compounding, they do not protect against sequence of return risk — the danger of hitting poor returns early in retirement when withdrawals begin.

Consider two retirees, both starting with R10 million and drawing R500,000 per year. Both face the same long-term average returns, but in different orders.

- Retiree A hits the worst years first. After just five years, their portfolio has dropped below R3.5 million. Within a decade, they are nearly out of money.

- Retiree B enjoys strong early years. After the same five years, their portfolio has grown to over R20 million, and by year ten it exceeds R32 million.

Same average return, radically different outcomes. The difference is not returns — it’s the sequence of returns.

This makes sequencing arguably the most dangerous risk for retirees. When you’re still saving, volatility is noise. In retirement, it can break your plan.

Managing Sequence Risk at Henceforward

At Henceforward, we blend ETFs with tools that smooth returns and protect income streams:

• Multi-asset income funds that can tilt defensively.

• Cash buckets covering 3–5 years of withdrawals, so growth assets aren’t sold at the wrong time.

• Smoothing funds and structured products that buffer against large drawdowns.

• Low-correlation hedge funds that diversify return sources.

This combination lets retirees benefit from the cost-efficiency of ETFs, while protecting against the destructive power of bad timing.

Further reading: Understanding investment risk and volatility in more detail

Active Funds Still Have a Role

ETFs are powerful, but they don’t solve everything. Active multi-asset funds, hedge funds, and specialist managers still play vital roles — particularly for retirees and income-dependent investors.

Case in Point: A South African client came to us with a retirement portfolio concentrated in high-cost active funds. By blending low-cost global ETFs for long-term growth with an active income fund for stability, we reduced annual costs by 0.8% while lowering sequencing risk. The client now enjoys broader diversification, reduced costs, and a smoother retirement journey.

Further Reading: The top performing funds available to South African investors

Final Thoughts

ETFs are powerful tools — but tools nonetheless. They are unmatched for cost-effective diversification and global reach, but they don’t replace the need for thoughtful planning, asset allocation, and active risk management.

At Henceforward, we use ETFs as core building blocks, combine them with active funds for stability and niche exposures, and wrap them in structures that handle tax and estate considerations. The result is not just an investment portfolio, but a plan that is robust, efficient, and built for the long term.

Steven Hall

Steven Hall, CFP®, is a co-founder and director of Henceforward. With years of experience in wealth management and holistic financial planning, Steven specialises in guiding South Africans toward smarter, lower-cost investment strategies that blend ETFs, active funds, and bespoke financial planning solutions.