Last Updated on 09/09/2025 by Carl-Peter Lehmann

When it comes to advanced estate planning tools, discretionary trusts often top the list, especially for family wealth planning. A discretionary trust is a type of living trust (or inter vivos trust) that you establish during your lifetime. In South Africa, these are frequently referred to as family trusts, as they typically house inter-generational family assets and serve as excellent vehicles for succession and legacy planning.

Why Choose a Discretionary Trust?

Discretionary trusts are particularly beneficial for individuals with a significant asset base who are looking to:

1.Protect their assets in the event of insolvency.

2.Reduce their estate duty obligations.

3.Ensure a smooth and seamless succession plan.

However, it’s important to note that trusts come in many forms and aren’t exclusively for the wealthy. They can be tailored to suit various needs and financial situations. In this piece we provide you with all the important detail.

Table of Contents

What Exactly is a Trust?

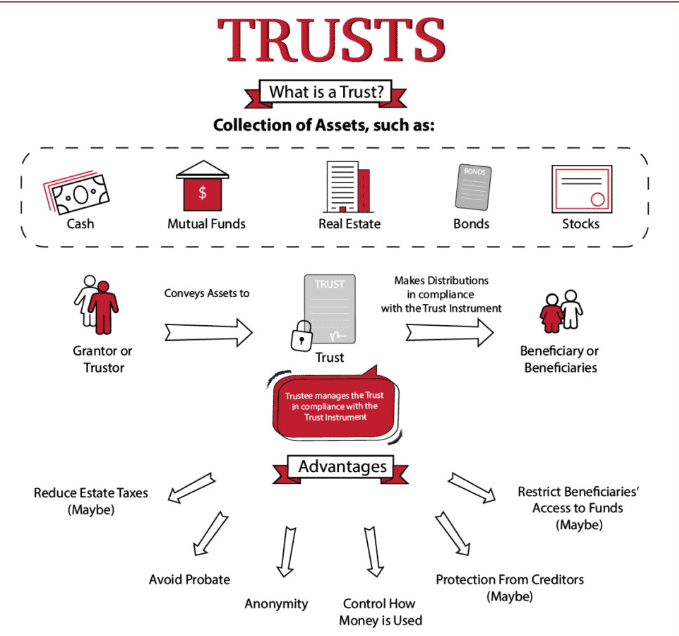

In simple terms, a trust is a legal arrangement where the holder of a right transfers it to another person or entity, who must then manage and use it for the benefit of a third party. There are three key parties involved in a trust:

1.The Founder or Settlor: The individual who establishes the trust.

2.The Trustees: The individuals or entities that become the legal owners of the trust property or assets.

3.The Beneficiaries: Those who benefit from the assets held within the trust.

While the specific terms and tax treatments of trusts can vary globally, the basic framework remains consistent. The image below provides a good visual representation to help you understand this structure better (even if its language speaks to more of an international audience):

Further reading: New regulations around discretionary trusts and making offshore distributions

Different Types of Trust Structures

While the focus on this piece is around discretionary trusts and the value they provide from an estate planning perspective, in South Africa we have a number of different trust structures that serve various purposes.

1.Inter Vivos or Living Trust

A discretionary trust is established by the founder during their lifetime and is governed by a trust deed. This crucial document outlines who the trustees, founder, and beneficiaries are, the powers and duties of the trustees, the conditions under which the trust can be wound up, and how the assets should be managed. Think of the trust deed as the ‘Bible’ that governs the trust’s operations and management.

The Role of the Trust Deed

The trust deed is central to the functioning of the trust. It:

- Identifies the key parties: the founder, trustees, and beneficiaries.

- Specifies the powers and duties of the trustees.

- Defines the conditions for winding up the trust.

- Details how the assets should be managed and distributed.

Discretionary Trusts in Estate Planning

In the context of estate planning, the discretionary trust (often called a family trust) is the most commonly used form of living or inter vivos trust. As the founder, you transfer assets to the trust through a donation or a sale via a loan account. These assets are then managed by the trustees on behalf of the beneficiaries, who can be specifically named (like your spouse, children, or yourself) or defined as a class of beneficiaries (such as grandchildren who are not yet known).

Roles Within the Trust:

1.Founder: The individual who establishes the trust and transfers assets into it.

2.Trustees: The individuals or entities responsible for managing the trust’s assets. The founder can also serve as a trustee and beneficiary, but it’s essential to have at least one independent trustee. This ensures that the trust is not seen merely as an extension of the founder, thereby demonstrating independence.

3.Beneficiaries: Those who benefit from the trust’s assets. Beneficiaries can be named individuals or classes of individuals.

Trustees’ Discretion

One of the key features of a discretionary trust is that the trustees have absolute discretion over how and when to allocate income and/or capital to the beneficiaries. While the founder can provide a letter of wishes to guide the trustees, this letter is not binding. The flexibility afforded by this discretion means that the beneficiaries do not have a vested right to the income or capital from the trust.

2.Vesting Trust

While discretionary trusts offer significant flexibility, a vesting trust operates quite differently. In a vesting trust, the trustees have no discretion, and the beneficiaries’ rights to income or capital are fixed and predetermined by the trust deed.

Key Characteristics of Vesting Trusts

- Fixed Rights: Beneficiaries have a vested right to the trust’s income or capital, as specified in the trust deed. This means that the terms are set in stone, and trustees cannot alter the distribution.

- Estate Duty: Unlike discretionary trusts, the assets in a vesting trust are subject to estate duty upon the death of the beneficiary.

- Creditor Protection: Beneficiaries do not enjoy creditor protection with a vesting trust, meaning the assets can be claimed by creditors if the beneficiary faces financial difficulties.

When to Consider a Vesting Trust?

Although the estate planning benefits of a vesting trust are more limited compared to a discretionary trust, there are scenarios where a vesting trust might be advantageous:

1.Control Over Distribution: If the beneficiaries are young, financially inexperienced, or not yet responsible enough to manage a large amount of money, a vesting trust can provide a structured approach to distribution.

2.Predetermined Outcomes: For families wanting clear, predetermined outcomes regarding asset distribution, a vesting trust ensures that the trust deed’s terms are followed precisely, with no room for discretionary decisions.

3.Testamentary Trust: A Posthumous Planning Tool

A testamentary trust is distinct from both discretionary and vesting trusts in that it is established through your Last Will and Testament and only comes into effect upon your death. This type of trust is particularly useful for providing for minor beneficiaries and managing assets efficiently after your passing.

Key Characteristics of Testamentary Trusts

1.Creation and Validity: A testamentary trust is created via your Will. If your Will is invalid for any reason, the trust will not be established. This underscores the importance of having a valid and well-drafted Will.

2.Purpose: Often used to avoid having assets intended for minor children being administered by the Guardians Fund. The Guardians Fund is controlled by the State through the Master of the High Court, which can involve significant bureaucracy and inefficiency. Moreover, the trust assets may not be invested in the most beneficial manner for the beneficiaries.

Choosing Trustees

Deciding who to appoint as trustees is a crucial part of setting up a testamentary trust. Here are some considerations:

Knowledge and Skills: Trustees should have the expertise to manage the trust according to your intentions.

Avoiding Conflicts of Interest: It may be wise for the guardian of minor beneficiaries not to also serve as a trustee. While their views can be considered, separating these roles can help avoid potential conflicts of interest.

Uses of a Testamentary Trust

While testamentary trusts are often used to provide for minor beneficiaries, they can also serve other purposes:

- Provision for a Spouse: Ensuring that your spouse is financially supported after your passing.

- Managing Assets for Irresponsible Beneficiaries: Preventing assets from being wasted by beneficiaries who may not be financially responsible.

4.Special Trust Status

A testamentary trust can qualify as a special trust if the youngest minor beneficiary is under the age of 18. This qualification provides certain tax advantages, which can be beneficial in preserving the trust’s assets for the beneficiaries. Special tusts are typically established for the maintenance of a person with a mental illness or any serious physical disability that prevents them from earning an income or managing their own affairs. Special Trusts are taxed at individual rates rather than trust rates

Benefits of a Discretionary Trust

1.Protection of Vulnerable Beneficiaries: A discretionary trust can protect minor beneficiaries, as well as those suffering from mental illness or physical disabilities. In some cases, a testamentary trust or special trust might be more appropriate, as they can be simpler and less expensive to set up and manage.

2.Creditor Protection: Assets in a discretionary trust are protected from creditors if the founder or a beneficiary becomes insolvent, provided that no vested interest exists.

3.Estate Duty Savings: Once assets are transferred to the trust, any future growth of those assets remains outside of the estate, potentially reducing estate duty obligations. If assets are sold to the trust via a loan account, only the loan account remains in the settlor’s estate for estate duty purposes. This loan can be repaid using the annual R100,000 donations tax allowance, thereby reducing its value over time.

4.Intergenerational Wealth Planning: Discretionary trusts facilitate long-term inter-generational family wealth planning. Because a trust does not die, beneficiaries and future generations can continue to benefit from the capital and income generated by the trust, as provided for in the trust deed. This is the essence of the family trust arrangement often used in South Africa to preserve family wealth across generations.

Important Considerations

Arms-Length Transactions: When assets are sold to a discretionary trust via a loan account, the transaction must be conducted on an arms-length basis. Interest-free loans can trigger anti-avoidance regulations. Therefore, loans should be made at commercial terms, generally accepted as the REPO Rate + 1%.

Taxation of Discretionary Trusts and the Conduit Principle

The taxation of trusts is highly complex and specialized, so we’ll provide a basic understanding here. Generally, all trusts, unless deemed special trusts, pay income tax at a flat rate of 45% and Capital Gains Tax (CGT) at an effective rate of 36%, which is significantly higher than individual tax rates.

Conduit Principle

To achieve more efficient tax treatment, trusts can utilize the conduit principle. Here’s a simplified explanation:

If income or gains are distributed to beneficiaries in the same tax year they are accrued, these amounts are considered to have been accrued by the beneficiaries, not the trust (SA tax resident beneficiaries assumed). As a result, the beneficiaries pay tax on the income or gains according to their individual tax rates.

However, this becomes increasingly complicated when beneficiaries live all over the world (as is becoming increasingly common) … and the need for specialised tax advice becomes important.

Proper administration of trust assets, including maintaining accurate records, documenting decisions, and effectively distributing income, is crucial for tax planning and compliance. This ensures that if authorities ever scrutinize the trust, all management practices are in order.

Divorce and Trusts: Discretionary Trusts in Divorce Settlements

In divorce and settlement negotiations, a correctly structured and managed discretionary trust will not be part of the founder’s estate, as the assets are owned and controlled by the trustees for the beneficiaries’ benefit. However, if the settlor retains effective control over the trust assets (the alter ego concept), courts may treat these assets as part of the personal estate, subject to divorce claims.

Proper establishment and management of a trust are crucial for its effectiveness. Tax authorities, including SARS, are increasingly scrutinizing trusts to ensure they are not mismanaged, which can lead to unwanted tax implications and undermine the trust’s purpose, such as asset protection in cases of divorce or insolvency.

Discretionary Trust Cost: Costs of Establishing and Administering a Trust

The costs associated with establishing and managing a trust are critical factors in determining its viability. These costs will vary depending on the size and complexity of the assets involved.

Domestic vs. Offshore Trusts

- Domestic Trusts: Generally easier and cheaper to set up and administer. You don’t need to appoint corporate trustees; instead, you can appoint someone like your accountant as an independent trustee, which can save on fees.

- Offshore Trusts: More expensive due to the need for offshore corporate trustees. Setting up and administering an offshore trust can easily cost between USD 15,000 – 20,000 annually, particularly when using more ‘reputable’ offshore jurisdictions like Jersey, Guernsey, and Switzerland. This high cost means offshore trusts are typically viable only for those with USD 2 million or more to invest.

Proper Management and Compliance

Regardless of the type of trust, it is crucial to ensure that it is properly established and managed to be recognized as a separate legal entity. Cutting corners can lead to the trust being deemed an alter ego, negating its benefits. Proper management includes having a well-drafted trust deed, appointing independent trustees, and covering ongoing administrative costs, which can range from R5,000 to R20,000 annually for a South African Trust, depending on the complexity and size of the assets.

Additional Costs

- Asset Transfer Costs: Transferring assets to the trust may incur costs such as transfer duty, capital gains tax (CGT), and donations tax. These costs arise because changing ownership (from individual to trust) is considered a disposal from a CGT perspective.

- Donations and Loan Accounts: Donating assets to the trust incurs donations tax. Alternatively, selling assets to the trust via a loan account is another option, each with its own tax implications.

Deciding whether to establish a trust requires careful consideration of these costs and benefits, tailored to your specific financial situation and goals.

Further Reading: If you’re a South African expat planning on returning to SA, you may want to consider setting up an offshore trust before you do.

Key Considerations for Setting Up a Discretionary Trust

Setting up a discretionary trust requires careful thought and planning and should be done for the right reasons. If your primary objective is tax avoidance, SARS is likely to detect this as they become more sophisticated in targeting trust structures.

However, if your goal is to leave a legacy, protect your assets, and enhance your estate planning, then a discretionary trust can be a valuable tool. To ensure its effectiveness:

- Seek Professional Advice: Consult with experts to structure the trust correctly.

- Be Prepared to Give Up Control: Understand that you will no longer directly control the assets placed in the trust.

- Consider Costs and Administration: Be aware of the initial and ongoing costs and compliance obligations.

- Work with the Right People: Ensure you have competent trustees and advisors to manage the trust properly.

Conclusion

Discretionary trusts are not suitable for everyone, but in the right circumstances, they can be the ultimate advanced estate planning tool. It’s crucial to use them correctly if you’re considering this option. Professional advice and collaboration with corporate trustees increase the likelihood of proper implementation, though this comes with associated costs.

At Henceforward, we work with various specialists to help set up and manage both domestic and offshore trusts. Contact us if you would like to know more about how a discretionary trust can benefit your estate planning.

Carl-Peter Lehmann

Carl-Peter is a CERTIFIED FINANCIAL PLANNER and investment professional with more than 20 years experience, including having worked in offshore locations like the Channel Islands and Hong Kong. He is a Director and Partner at Henceforward. Henceforward facilitate and enable the use of intervivos discretionary trusts for their clients under the right circumstances, particularly to preserve and transfer family wealth to future generations.