Last Updated on 03/10/2025 by Carl-Peter Lehmann

Unit Trusts Explained … and the Best-Performing Unit Trusts in South Africa Currently

As we head into the end of August and the start of spring in South Africa, 2025 has been anything but quiet: tariff headlines, April’s sell-off, and a powerful rebound since have kept investors on their toes. Local equities have been notably resilient – helped by firm resource counters (especially gold) and a steadier rand – leaving SA equity exposure a compelling growth sleeve for long-term portfolios.

A key change this with this update: ETFs are now captured within the relevant ASISA equity categories, so they’re included for the first time in our rankings. That broadens the field and gives a clearer, apples-to-apples view of how active funds stack up against low-cost, rules-based strategies.

In this update (data to 25 August 2025), we spotlight the top-performing SA equity unit trusts over 3, 5 and 10 years, show peer-group medians and fund counts for context, and share practical takeaways to help you position for growth amid a still-shifting global backdrop.

Table of Contents

Unit Trusts Explained

Unit trusts pool money from multiple investors to create a diversified portfolio of assets, professionally managed to balance risk and return. Even with a small investment, unit trusts provide exposure to a broad range of asset classes, reducing the risk associated with holding a single stock or security.

When you invest in a unit trust, you’re essentially buying units in a professionally managed portfolio. The value of these units fluctuates based on the performance of the underlying assets, offering investors an efficient way to participate in financial markets without the complexity of direct stock selection.

Types of Unit Trust Funds

Unit trusts come in various forms, each catering to different investment needs:

1. Equity Unit Trusts: Focused on investing in shares of listed companies, offering higher growth potential but with greater volatility.

2. Multi-Asset Unit Trusts: Also known as balanced funds, these allow fund managers to blend different asset classes – such as equities, bonds, and cash – based on their mandate, providing a more diversified and actively managed approach.

3. Sector-Specific Unit Trusts: Concentrated on specific industries like technology, financials, or resources, offering targeted exposure to particular market segments.

4. Fixed Income & Money Market Unit Trusts: Primarily investing in bonds, cash, and other interest-bearing instruments, typically offering lower risk and more stability.

Active vs. Passive Funds

Most unit trusts are actively managed, meaning professional fund managers select and adjust holdings to maximize potential returns while managing risk. However, in the last decade, passive strategies – such as index funds and ETFs – have gained popularity due to their lower cost structure and consistent market exposure. These funds track established indices, providing a low-cost, hands-off approach to investing.

While unit trusts offer diversification, professional management, and ease of trading, it’s important to remember that all investments carry risks, and past performance does not guarantee future returns.

Discover Why: Understanding of the Psychology of Investing can ultimately help you become a more successful investor.

Different Types of Unit Trusts: Unit Trust Examples

Unit trusts come in a variety of investment styles and asset classes, catering to different risk appetites and financial goals. Whether you’re looking for growth, income, or capital preservation, there’s a unit trust designed to match your needs. The main categories include equity funds, bond funds, money market funds, and multi-asset funds, each with a distinct investment mandate.

To ensure meaningful comparisons, ASISA classifies unit trusts based on their objectives and underlying asset allocation, allowing investors to evaluate funds with similar strategies against one another. In South Africa, some of the most well-known equity unit trusts include the Allan Gray Equity Fund, Coronation Top 20 Fund, and Investec Equity Fund, among others – each offering a unique approach to stock selection and portfolio management.

Framing Equity Investing Return Expectations: As an equity investor, you’re typically aiming for returns of inflation plus 7–8% over the long term to be adequately compensated for the higher risk and volatility associated with investing in this asset class. Using inflation at 5% as realistic long-term anchor … that means a 12-13% p.a. return over the long term should be your minimum hurdle rate.

New ASISA SA Equity Classification

In an effort to enhance comparability among unit trusts, the Association for Savings and Investment South Africa (ASISA) implemented a reclassification of the SA Equity General category, effective 1 October 2024. This reclassification introduced two distinct categories:

SA Equity – SA General: This category comprises portfolios that invest exclusively in South African shares, maintaining 100% of their market value within the local market.

SA Equity – General: Portfolios in this category have the flexibility to invest a portion of their assets offshore, allowing for a diversified approach that includes both local and international equities.

According to ASISA, approximately 60 portfolios transitioned from the original SA Equity – General category to the newly established SA Equity – SA General category upon the reclassification. This strategic move acknowledges the differing return profiles between portfolios focused solely on local markets and those incorporating foreign investments, often influenced by currency fluctuations. By creating these distinct categories, ASISA aims to provide investors with a more meaningful basis for comparison, enabling better-informed investment decisions.

Further Reading: Avoid Making these 10 Costly Investment Mistakes

Best Performing Unit Trusts - South African Equities:

While ASISA’s reclassification now separates SA Equity funds into two categories – those with a pure South African focus and those that can invest a portion offshore – we will continue to report on the best-performing funds across both categories. Splitting them further would create unnecessary complexity, and ultimately, most investors care about one thing: where they can get the best returns.

From an investment perspective, we prefer funds with greater flexibility, as this allows managers to adjust domestic and offshore exposure based on evolving risks, opportunities, and market conditions. Having the ability to allocate capital globally when needed is an advantage, especially in volatile economic environments.

To ensure clarity, we will indicate which category each fund falls into – funds with a pure SA focus will either include ‘SA’ in their name or have (SA) added at the end. This way, investors can easily differentiate between funds while still seeing the top performers in the overall SA Equity space.

Further Reading: Who We Think the Best Asset Management Firms in SA Currently Are

Best Performing SA Equity Unit Trusts Over 3 Years

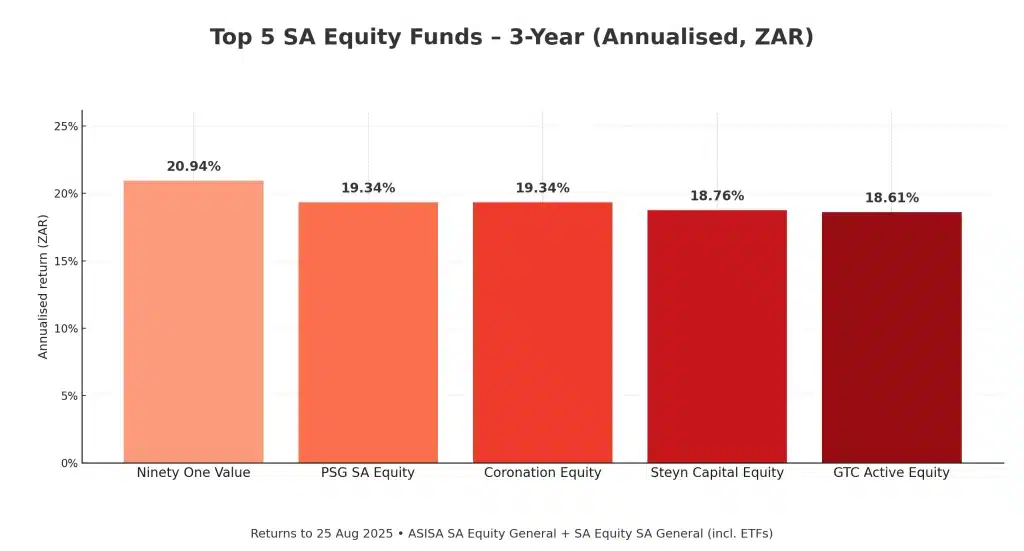

The SA equity universe remains highly competitive, with 204 funds showing at least a 3-year history (as at 25 August 2025). The peer-group median is 14.77% p.a., but dispersion is wide – highlighting how manager skill and style tilts have mattered. The leaders below have comfortably cleared the median.

Top 5 Best-Performing SA Equity Funds (3-Year Performance to 25 August 2025)

| Rank | Fund | 3-Year (ann.) |

|---|---|---|

| 1 | Ninety One Value | 20.94% |

| 2 | PSG SA Equity | 19.34% |

| 3 | Coronation Equity | 19.34% |

| 4 | Steyn Capital Equity | 18.76% |

| 5 | GTC Active Equity | 18.61% |

Key Takeaways

🔹 Ninety One Value leads (~20.94% p.a.): A sustained value tilt, aided by disciplined valuation work, pushed it well ahead of the median (~+6.2ppt spread vs peers).

🔹 PSG SA Equity & Coronation Equity (both ~19.34% p.a.): Broad, research-led approaches that travelled well across sectors; execution consistency shows up in the numbers.

🔹 Steyn Capital Equity (~18.76% p.a.): High-conviction, fundamentals-driven selection delivering clear alpha.

🔹 GTC Active Equity (~18.61% p.a.): Active core that’s outpaced the group, reinforcing the case for selective active management.

🔹 Dispersion remains meaningful: The gap between the winner and the median (~6ppt) underlines why manager selection matters.

Top Performing Unit Trusts in the Broader SA Equity Space Over 5 Years

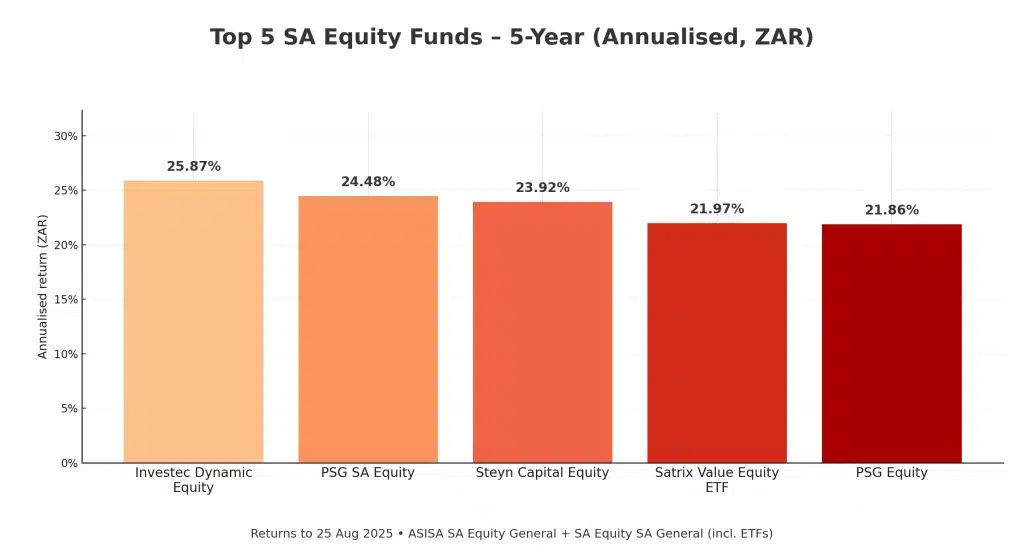

Over 185 funds with complete 5-year records (as at 25 August 2025), the peer-group median rises to 15.76% p.a. The top names have delivered persistent alpha through shifting local market cycles and factor regimes.

Top 5 Best-Performing SA Equity Funds (5-Year Performance to 25 August 2025)

| Rank | Fund | 5-Year (ann.) |

|---|---|---|

| 1 | Investec Dynamic Equity (SA) | 25.87% |

| 2 | PSG SA Equity | 24.48% |

| 3 | Steyn Capital Equity | 23.92% |

| 4 | Satrix Value Equity ETF | 21.97% |

| 5 | PSG Equity | 21.86% |

Key Takeaways

🔹 Investec Dynamic Equity tops the list (~25.87% p.a.): A nimble, style-aware approach has compounded meaningfully ahead of peers (~+10ppt over median).

🔹 PSG SA Equity (~24.48% p.a.) & Steyn Capital Equity (~23.92% p.a.): Consistent alpha from concentrated, fundamentals-first portfolios.

🔹 Satrix Value Equity ETF (~21.97% p.a.): Factor value has worked over this window, showing a rules-based route can still deliver.

🔹 PSG Equity (~21.86% p.a.): Classic active core with strong medium-term execution.

🔹 Wide dispersion: The spread from median (15.76%) to the top performer (~25.87%) is ~10ppt, reinforcing the payoff to manager and style selection.

Best Performing Unit Trust Funds Over 10 Years in the SA Equity Space

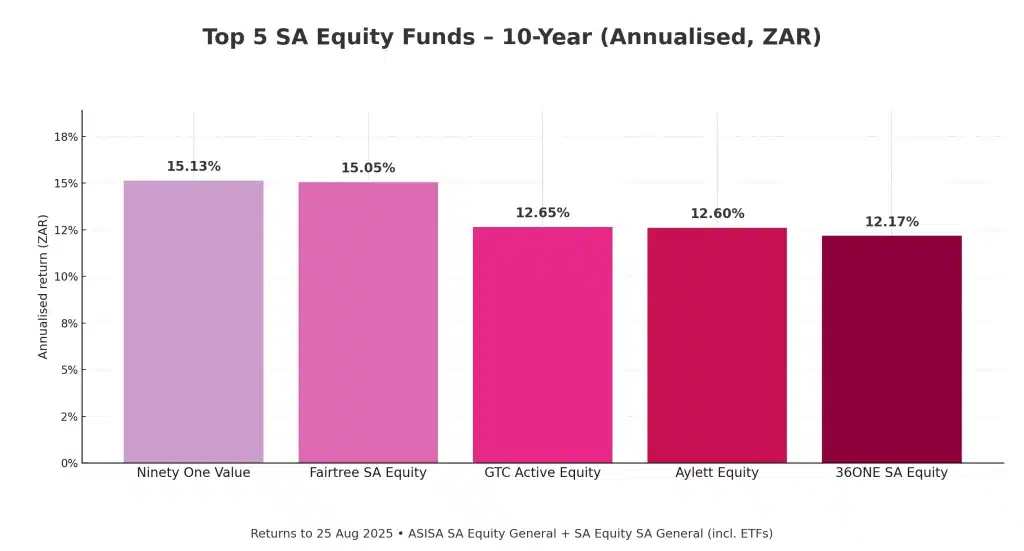

On the decade view, 125 funds make the cut, with a peer-group median of 9.19% p.a. The leaders below have out-compounded consistently through multiple market regimes.

Top 5 Best-Performing SA Equity Funds (10-Year Performance to 25 August 2025)

| Rank | Fund | 10-Year (ann.) |

|---|---|---|

| 1 | Ninety One Value | 15.13% |

| 2 | Fairtree SA Equity | 15.05% |

| 3 | GTC Active Equity | 12.65% |

| 4 | Aylett Equity | 12.60% |

| 5 | 36ONE SA Equity | 12.17% |

🔹 Ninety One Value (~15.13% p.a.) & Fairtree SA Equity (~15.05% p.a.): Long-run leaders with repeatable processes; both ~6ppt ahead of the peer median.

🔹 GTC Active Equity (~12.65% p.a.) & Aylett Equity (~12.60% p.a.): High-conviction stock-picking that’s compounded steadily over a full cycle.

🔹 36ONE SA Equity (~12.17% p.a.): Active, opportunistic style delivering solid decade-long alpha.

🔹 Lesson for investors: Over long horizons, process consistency and sensible risk control tend to dominate short-term style noise.

Now Read: How Some of the Top Performing Hedge Fund Returns Compare

South Africa’s Standout Long-Term Unit Trust and ETF Performers

Best-Performing Unit Trusts in South Africa Over 10 Years (Across All Categories)

As at 25 August 2025, we’re expanding this long-term leaderboard to reflect an important change in the local landscape: ETFs are now included within the relevant ASISA categories and therefore feature in this roundup for the first time. While global equity strategies have often dominated over a decade, a mix of South African-domiciled sector specialists, flexible mandates, and now ETFs have outpaced even the best global peers.

Because resource funds would otherwise crowd the list, we’ve included only the best resource fund to keep the ranking balanced. Notably, the broadened universe means ETF leaders – like actively managed and broad-market trackers – can now stand shoulder-to-shoulder with active unit trusts in the top five.

1️⃣ Old Mutual Gold Fund – 23.11% p.a.

A powerful decade for gold has propelled this specialist strategy to the top. The fund’s focused exposure to gold equities has amplified the cycle — delivering exceptional long-run compounding, albeit with higher volatility.

2️⃣ EasyETFs Global Equity Actively Managed ETF – 22.41% p.a.

An actively managed global equity ETF that’s captured persistent mega-cap and innovation themes. The dynamic overlay has helped it stay on the right side of shifting leadership while maintaining broad global breadth.

3️⃣ BlueQuadrant Worldwide Flexible Fund – 18.85% p.a.

An unconstrained, high-conviction approach that allocates across geographies and sectors. Despite periodic drawdowns, its flexible mandate and stock-picking have compounded strongly over the full decade.

4️⃣ Sygnia Itrix MSCI USA ETF – 16.65% p.a.

A low-cost route to US large caps — benefiting from the sustained dominance of US mega-cap growth and profitability over the last 10 years.

5️⃣ Old Mutual Global Equity – 15.43% p.a.

A diversified, active global strategy with a quality/growth tilt that’s delivered durable, benchmark-beating returns through multiple market regimes.

📌 Takeaway: The resource cycle has been a decisive tailwind — hence our choice to feature only the top resource fund to avoid crowding the list. Beyond commodities, both active flexible and global equity exposures have proven they can out-compound over long horizons, reinforcing the value of pairing core global building blocks with selective high-conviction strategies.

Don’t forget to read our piece on the best global equity funds in SA currently.

The Value of Advice: Crafting Portfolios for Long-Term Success

Investing in unit trusts is relatively straightforward — whether through a lump sum or monthly debit order. But while past performance is often the first metric investors gravitate towards, it should never be the sole driver of investment decisions. Chasing recent winners, particularly in highly cyclical sectors like resources and commodities, can be risky. These sectors often go through intense boom-and-bust cycles, meaning that today’s chart-topper could easily become tomorrow’s underperformer.

That’s why a better starting point is understanding your long-term goals, time horizon, risk appetite, and liquidity needs — and then constructing a portfolio that reflects those realities. This is where professional advice becomes crucial. A skilled financial planner or wealth manager won’t simply plug you into last year’s best-performing fund. Instead, they’ll help you build a robust, diversified portfolio designed to weather different market cycles and deliver more consistent, sustainable outcomes over time.

Because investing isn’t about finding the next hot streak — it’s about discipline, structure, and forward-thinking portfolio design. If past performance were all that mattered, we’d all be wealthy. But the real edge lies in a clear strategy, proper asset allocation, and the confidence to stick with it through both good times and bad.

Read Next: The Best Performing Unit Trusts in the Global Equity Category and How They Compare

Ready to Invest with Purpose?

If you’re a professional or millennial (accumulator) with R10 million+ to invest … or a retiree with R20 million+ in investable assets, we’d love to help you structure a portfolio designed for long-term success. Reach out via our contact form below.

Conclusion

Comparing unit trust performance is no easy task, which is why we’ve put together this analysis of the top-performing funds in the SA Equity General category – to provide you with a starting point in an otherwise complex landscape. At Henceforward, we know that building the right investment portfolio isn’t just about looking at past returns. True investment success comes from aligning a portfolio with a person’s unique needs, risk tolerance, and long-term objectives. That said, we still believe in monitoring and understanding fund performance trends, ensuring that we are always considering the best possible options for our client portfolios. Great investing isn’t about chasing past winners – it’s about making smart, strategic decisions that stand the test of time.

Download the Henceforward “8 Secrets to Investment Success” Guide

Not on our newsletter yet? You can still grab your copy of our 8 Secrets to Investment Success … a practical, jargon-free guide to making smarter investment decisions.

What you’ll learn (in plain English):

1. The core principles that compound results over time

2. How to build a simple, resilient investment process

3. Common mistakes to avoid (and what to do instead)

4. A checklist you can use before every investment decision

Whether you’re aiming for financial independence, a stronger retirement pot, or just more confidence with your money, this guide gives you a clear, repeatable framework – no hype, no fluff.

Get the guide now — or subscribe to our newsletter and it’ll be sent to you automatically.

Carl-Peter Lehmann

Carl-Peter is a Certified Financial Planner (CFP®) and Director at Henceforward, specializing in global investing and wealth management. With over 20 years of experience, he helps clients navigate global and local markets, building strategic, goal-driven investment portfolios tailored for long-term succes