Last Updated on 05/09/2025 by Carl-Peter Lehmann

Comprehensively Assessing the Benefits of a Retirement Annuity

As we edge toward the end of August and the start of spring in South Africa, 2025 has already packed a punch: tariff talk flared up again, April’s sell-off rattled nerves, and the rebound since has been remarkable. Through it all, retirement investing hasn’t become any less important … if anything, market whiplash underscores why a disciplined, Regulation-28-aware approach matters.

Retirement annuities (RAs) remain a cornerstone for long-term retirement investors: they enforce contribution discipline, offer powerful tax benefits, and channel capital into diversified balanced funds designed to ride out volatility. With fresh performance data to 25 August 2025, it’s the right moment to revisit which managers are actually delivering.

In this update, we re-affirm the role of RAs in building a bigger end-retirement pot and highlight the top-performing balanced funds over 3, 5 and 10 years – showing peer-group medians and fund counts for context. The goal: help you see which strategies are truly compounding, despite a noisy year, so you can align your RA choices with your long-term retirement goals.

Table of Contents

Understanding the Aims of a Retirement Annuity

A retirement annuity serves as a valuable tool to help you achieve financial security in your retirement years. It acts as an investment product that provides tax advantages, incentivizing you to save for your future. The government encourages personal retirement savings to reduce dependence on state-funded support during old age. If you belong to an employer-sponsored fund, such as a pension or provident fund, a retirement annuity can supplement your existing retirement savings. For those who are self-employed or not part of an employer fund, a retirement annuity can become your primary investment for retirement—a personal pension plan.

Decoding How Retirement Annuities Work

When you opt for a retirement annuity, you can make regular contributions or lump sum payments. Additionally, you have the freedom to choose how your retirement annuity funds are invested, which we’ll discuss in more detail later. Think of the retirement annuity as a protective “wrapper” that houses your investments. The type of wrapper, in this case, the RA, determines the tax implications, as different investment wrappers have varying tax consequences. When you reach the minimum retirement age of 55, you can use the funds accumulated in your retirement annuity to invest in a post-retirement product. These products, such as living annuities or guaranteed life annuities, provide you with a regular income stream during your retirement years. Modern retirement annuities offer flexibility, allowing you to start or stop contributions based on your financial circumstances, such as periods of financial difficulty or job loss.

Understanding the New Two-Pot Retirement System

South Africa’s new two-pot retirement system, which was implemented on 1 September 2024, aims to balance long-term retirement savings with short-term financial flexibility. Under this system, retirement contributions will be split into two pots: a retirement pot, which remains preserved until retirement, and a savings pot, which allows limited withdrawals before retirement to help individuals access funds in times of financial need. While this offers greater liquidity, it also requires careful planning to avoid depleting future retirement savings.

For a detailed breakdown of how the two-pot system works and what it means for your retirement planning, read our full article here.

Exploring Investment Options for RAs

All retirement annuities in South Africa are governed by Regulation 28 of the Pension Funds Act, which sets limits on asset allocation to ensure diversification and risk management in retirement savings. Under the current guidelines, retirement annuities can invest up to 75% in equities and 45% offshore, reflecting the increased offshore allowance from the previous 30% limit. In addition to equities, retirement annuity portfolios can include bonds, property, hedge funds, and cash, allowing for diversified investment strategies. Given these restrictions, most retirement annuity assets in South Africa are allocated to balanced funds that comply with Regulation 28. These funds typically fall under the South African Multi-Asset High Equity category, as classified by ASISA, making them the default choice for long-term retirement savers.

The Biggest Benefits of a Retirement Annuity. All the Tax Benefits

Retirement annuities offer several key advantages that contribute to disciplined and flexible retirement planning. One significant benefit of a retirement annuity is that you cannot access the funds until you reach the minimum retirement age (currently 55), ensuring that your retirement planning remains on track without succumbing to temptation. Let’s explore the tax benefits associated with retirement annuities:

1. Tax-Free Growth: The funds invested in a retirement annuity grow tax-free, meaning you are exempt from income tax or capital gains tax on the investment’s growth.

2. Tax-Deductible Contributions: Contributions made to a retirement annuity are tax-deductible, up to a maximum of 27.5% of your gross income or capped at R350,000 per annum. This allows you to reduce your taxable income by the amount of your contribution.

For example, let’s say you earn R1 million per year gross. Assuming no other factors, you would pay approximately R300K in taxes for the year. However, if you contribute 10% or R100K p.a. to a retirement annuity (whether monthly or as a lump sum), your taxable income decreases to R900,000. As a result, the tax you pay reduces to approximately R257K for the year, saving you over R40K in taxes.

3. Estate Duty Savings: All allowable contributions (and growth) fall outside of your estate for estate duty calculation purposes on death.

Accessing Your Retirement Annuity: Estimating Your Retirement Income

Once you reach the age of 55 or decide to retire, you can access the total value of your retirement annuity. This value comprises your contributions and the growth accumulated in your investments. You have the option to withdraw up to one-third of the total value as cash. The first R550K of this cash withdrawal is tax-free, assuming you haven’t previously utilized any portion of this tax-free allowance. The remaining balance is used to purchase a product specifically designed to provide you with a steady income stream throughout your retirement years. A rule of thumb figure to use as a sustainable income level, would be a starting drawdown rate of about 4% p.a. So for every R1 million invested you should be able to generate about R40,000 p.a. before tax. While this income is taxable, tax rates during retirement are typically lower compared to your working years. If the total value of your retirement annuity is less than R247,500, you have the option to withdraw the entire amount in cash.

Finding the Best Retirement Annuity in South Africa: What Really Matters

Determining the best retirement annuity depends on your specific needs and investment criteria. Key factors to consider include fees, long-term performance, and the quality of underlying investments. While many investors focus on the institution or platform managing their retirement annuity – such as Old Mutual, Allan Gray, Glacier, or Ninety One – what truly drives returns is the selection of funds within your RA. The platform is simply a vehicle; the investment strategy is what ultimately determines growth.

For most retirement annuities, balanced funds are the preferred investment choice, as they align with Regulation 28’s asset allocation limits. These funds typically have a long-term return objective of Inflation Plus 5% (which today roughly means achieving a return of 10% p.a. and above), meaning they aim to deliver returns that outpace inflation by 5% per year over time. Achieving this benchmark is crucial for retirement savers, as it ensures that their investments grow in real terms, preserving and enhancing purchasing power in retirement. However, not all balanced funds succeed in meeting this target, making fund selection a critical decision.

Interestingly, the top-performing balanced funds are often not managed by the biggest financial brands but instead come from boutique or specialist asset managers with a strong track record of delivering consistent returns.

To help investors make informed choices, we’ve analyzed Morningstar data (as of 25/08/2025) to identify the best-performing balanced funds as potential options for your retirement annuity. All performance data is based on retail fee classes to ensure comparability.

Performance Context: Why Fund Selection Matters in Retirement Annuities

One of the key advantages of retirement annuities in South Africa is the wide range of investment choices available. With approximately about 260 balanced funds in the market – 227 of which have at least a 3-year track record – this category offers more options than any other. This is largely because retirement savings represent the largest pool of investor capital, making it a prime market for asset managers. However, with so many options, not all funds deliver strong returns, reinforcing the importance of careful fund selection.

The performance gap between balanced funds has widened significantly, particularly in the wake of recent offshore investment limit increases. The ability of fund managers to effectively allocate capital between local and international markets has become a major driver of returns. For example, the best-performing Long Beach Managed Fund delivered 23.68% p.a. over 3 years, while the worst-performing Caleo Balanced FOF returned just -0.67% p.a. … a stark difference that highlights the risks of choosing the wrong fund.

For investors seeking to avoid underperformers, we’ve also analyzed the worst-performing balanced funds, which you can read about here.

Best Performing Retirement Annuity in (Balanced Funds) South Africa Over 3 Years

With 227 balanced funds in South Africa now boasting at least a 3-year track record (as at 25 August 2025), competition among managers remains fierce. Encouragingly, the peer-group median return is 13.12% p.a., reflecting a supportive backdrop for growth-oriented strategies. Still, only a select few funds have delivered exceptional outperformance well above both the peer median and the popular Inflation-plus-5% target used by retirement-focused investors.

Top 5 Best-Performing Balanced Funds (3-Year Performance to 25 August 2025)

| Rank | Fund | 3-Year (ann.) |

|---|---|---|

| 1 | Long Beach Managed | 23.68% |

| 2 | High Street Balanced | 21.19% |

| 3 | Granate Balanced | 20.34% |

| 4 | Foord Domestic Balanced | 20.32% |

| 5 | ABAX Balanced | 18.77% |

These funds have delivered outstanding returns through a highly eventful and unpredictable market cycle. For investors using retirement annuities as a long-term savings vehicle, choosing managers like these can materially improve the odds of meeting your retirement goals. In the accumulation phase – where sequencing risk matters less – the priority is maximising growth within Regulation 28 constraints to build the largest possible pot at retirement, accepting that inflation is uncertain and volatility is the price of higher returns.

Do Read: Our interview with David Hansford of Long Beach and Why his Fund Outperforms

Top performing balanced funds for retirement annuity investment over 5 years

Across 211 balanced funds with a full 5-year record (as at 25 August 2025), the peer-group median sits at 12.32% p.a. The leaders below have shown durable, cycle-tested execution, compounding materially ahead of the median through differing market regimes.

Top 5 Best-Performing Balanced Funds (5-Year Performance to 25 August 2025)

| Rank | Fund | 5-Year (ann.) |

|---|---|---|

| 1 | Granate Balanced | 19.69% |

| 2 | ABAX Balanced | 19.35% |

| 3 | PSG Balanced | 19.09% |

| 4 | PSG Investment Management Growth FoF | 18.42% |

| 5 | Perspective Balanced | 18.06% |

These top balanced funds have compounded at roughly 19–20% p.a. over five years. Just as encouraging, the peer group as a whole also cleared the typical RA benchmark, with the median around 12.3% p.a., i.e., above Inflation + 5%. For savers in the accumulation phase, that’s exactly the kind of growth that maximises the capital available at retirement within Regulation 28 constraints … accepting volatility as the price of higher long-term returns.

Best Performing Balanced Funds Over 10 Years for RA Investment: The Long-Term Reality

Long-term results tell the truest story. Among 127 balanced funds with a decade-long record (as at 25 August 2025), the peer-group median is 8.34% p.a. (not so good). The standouts below have delivered sustained, long-run compounding well above the pack.

Top 5 Best-Performing Balanced Funds (10-Year Performance to 25 August 2025)

| Rank | Fund | 10-Year (ann.) |

|---|---|---|

| 1 | Long Beach Managed | 14.26% |

| 2 | Aylett Balanced | 13.32% |

| 3 | ABAX Balanced | 12.51% |

| 4 | Centaur Balanced | 12.35% |

| 5 | Camissa Balanced | 10.59% |

Over a full decade, the standouts have shown real staying power. Long Beach Managed and ABAX Balanced have been consistently among the top performers across multiple horizons, underscoring a durable process rather than a one-off style tailwind. Aylett Balanced has likewise been one of the best long-running funds, posting one of the strongest 10-year records in the peer group. And while Granate Balanced dominates the 3–5 year tables, it doesn’t yet have a full 10-year track record – one to watch as its history lengthens.

The Role of Low-Cost Passive Balanced Funds in Retirement Annuities

When selecting the best retirement annuity options in South Africa, investment fees have become a crucial consideration due to their long-term impact on portfolio growth. In recent years, low-cost balanced funds, also known as passive balanced funds or index-based balanced funds, have gained traction as viable alternatives to traditional actively managed options.

Industry leaders such as Sygnia, Satrix, and 10X have been at the forefront of this shift, offering funds that rely primarily on indexation strategies rather than individual stock or security selection. While often referred to as “passive,” these funds still involve active asset allocation decisions, particularly in balancing local and offshore exposure. The key advantage is their cost efficiency, with Total Investment Charges (TIC) typically ranging between 0.50% and 0.70% per annum—considerably lower than many actively managed balanced funds.

Within the main “passive” balanced cohort — five-year returns cluster around the broader balanced-fund peer median of 12.32% p.a. across 211 qualifying funds (combined ASISA SA MA High Equity + SA MA SA High Equity).

The table below compares each fund’s annualised 5-year return and peer-group rank of Low Cost ‘Passive’ Balanced Funds.

| Rank (of 211) | Fund | 5-Year (ann.) |

|---|---|---|

| 26 | Satrix Balanced Index | 14.63% |

| 48 | Nedgroup Core Diversified | 13.58% |

| 52 | 10X Your Future | 13.44% |

| 67 | Prescient Balanced | 13.14% |

| 92 | Sygnia Skeleton Balanced 70 | 12.52% |

| 208 | Gryphon Prudential | 6.38% |

**Universe dispersion for context: Top fund ~19.69% p.a., Top-decile cutoff ~15.04% p.a., Median 12.32% p.a., 10th percentile ~9.74% p.a.

Among passive balanced options, Satrix Balanced Index Fund is the standout over five years, landing in the top quartile of the entire balanced universe and clearly above the peer median. Nedgroup Core Diversified and 10X Your Future also sit comfortably above median, while Prescient Balanced is just below the upper-middle and Sygnia Skeleton Balanced 70 is around the median. Gryphon Prudential, by contrast, has materially lagged, driven largely by sub-optimal asset allocation choices and elevated cash holdings over the period — a stance that dampened compounding versus peers in a market that rewarded risk assets.

Managing Your Retirement Annuity in the Event of Your Death

In the unfortunate event of your passing, the value of your retirement annuity falls outside of your estate, eliminating the need for estate duty. The distribution of benefits is regulated by section 37C of the Pension Funds Act. Trustees of the fund exercise their discretion to identify and arrange equitable payment of the benefits to your dependents, both legal and factual, even if you have nominated a beneficiary. The definition of a dependent is broad, and the trustees have the final say, making the process potentially complicated. To better understand the intricacies and challenges surrounding section 37C, we recommend reading this informative article on the subject.

Once the trustees have determined how to distribute the benefits among your dependents, they can choose to receive the amount as cash (subject to taxation) or use the capital to purchase an income-generating product through a living or life annuity.

Retirement Annuities vs. Offshore Investing: What’s the Right Balance?

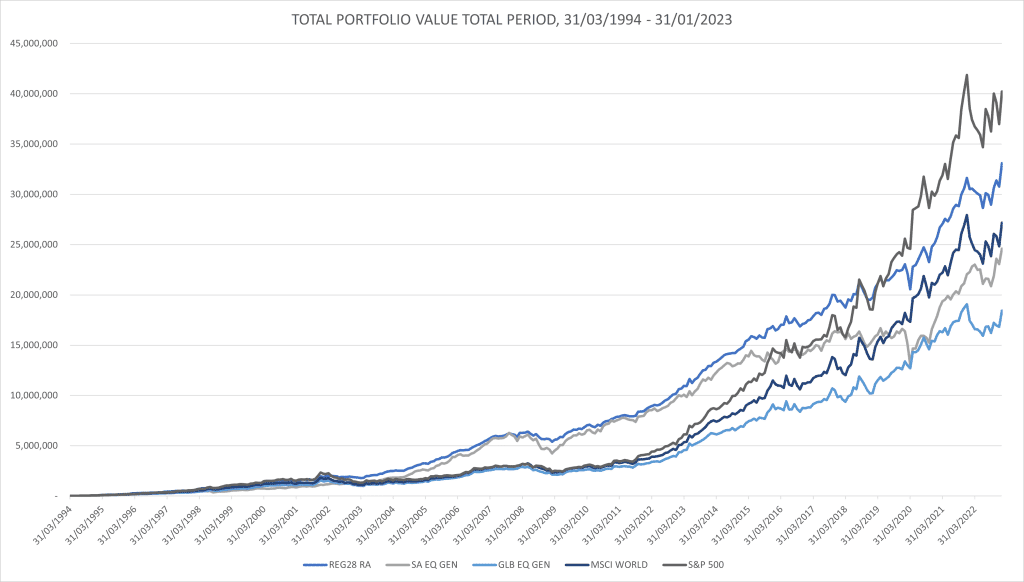

A longstanding debate in financial planning is whether the tax benefits and incentives of a retirement annuity (RA) outweigh the potential advantages of offshore investing, which offers broader opportunities and often higher returns.

Consider this: The Rand has depreciated by an average of 5-6% per year over the last 30 years. How do you make up for that loss in purchasing power? This is even more relevant today as global mobility, travel, and emigration become top priorities for many South Africans.

So, should offshore investing be a cornerstone of your retirement and financial independence strategy? While RAs provide compulsory savings discipline and tax efficiency, their Regulation 28 restrictions limit offshore exposure to 45%, which may not be enough to truly hedge against local risks and currency depreciation.

Ultimately, achieving financial security in retirement is about striking the right balance – leveraging the tax advantages of an RA while ensuring enough offshore diversification to protect and grow wealth in a globalized world.

Now Read: Offshore Investing and Some Top Offshore Investment Strategies for South African Investors Today

Freqeuently asked questions about retirement annuities and their performance

-

1. How much of my RA contribution is tax-deductible?

Up to 27.5% of the higher of your taxable income or remuneration, capped at R350,000 per tax year. The cap applies across all retirement funds combined (pension, provident, and RA). You claim it via your tax return (or through payroll if your provider reports it).

-

2. What happens if I contribute more than the limit?

Excess contributions are not lost. SARS carries them forward to future tax years, and they can also increase the tax-free portion of your retirement lump sum or reduce tax on your annuity income after retirement.

-

3. Is growth inside my RA tax-free?

Yes ... within an RA there’s no SA tax on interest, dividends, or capital gains, so returns compound tax-free. (Note: some foreign withholding taxes may apply at source inside underlying global holdings; these aren’t levied by SARS and typically aren’t reclaimable by you.)

-

4. How are benefits taxed when I retire?

You can usually take up to one-third as a lump sum (taxed per the SARS retirement lump-sum tax tables) and must use the balance to buy an annuity; annuity income is taxed at your marginal rate. Check the latest SARS tables before deciding.

-

5. What counts as “balanced” here when talking about the best investments for RA's?

We combine (ASISA) SA MA High Equity and (ASISA) SA MA SA High Equity. These are the multi-asset funds typically used for Regulation-28 compliant RAs.

-

6. Do these funds all meet Regulation-28 limits?

Balanced funds are generally designed to do so, but verify on the latest factsheet - limits can change and some classes/feeder structures differ.

-

7. How should I use the Top 5 performing funds listed?

As a shortlist—combine with costs, mandate fit, drawdown behaviour and your RA provider’s platform list. Don’t pick on return alone.

-

8. How do I open a Retirement Annuity online?

Pick a reputable platform (e.g. Sygnia, 10X, Allan Gray). Create an account, complete FICA, choose your monthly debit order or lump sum, select your fund(s), add beneficiaries, and submit. Most platforms let you do everything in ~10–15 minutes

-

9. Do I need an adviser?

Not required to get started. If your situation is complex (multiple funds, preservation/transfer, estate planning), consider advice.

-

10. What’s the bigger RA risk - market volatility, or being stuck in a chronically underperforming balanced fund? How do I check if mine’s on track?

The bigger risk is compounding too slowly in a fund that persistently lags. Aim for CPI + 5% p.a. and at least the peer-group median (ASISA SA MA High Equity). Once or twice a year, compare your fund’s 3/5/10-year, net-of-fee returns to those two hurdles. If it’s below both for 3–5 years, switch to a stronger Reg-28 balanced option ... keep costs low and avoid unnecessary churn.

Conclusion: A Balanced Approach to Retirement Investing

Retirement annuities remain a valuable tool in a well-structured retirement strategy, offering significant tax benefits and estate planning advantages. With a growing selection of low-cost options and top-performing boutique managers, they continue to be a solid foundation for long-term retirement savings.

However, relying solely on a retirement annuity may not be enough to achieve true financial independence. Given Regulation 28 limits and long-term Rand depreciation, alternative strategies like offshore investing should be a core component of a diversified retirement plan. Global markets offer greater opportunities for growth, and investing in hard currencies (such as USD) rather than feeder funds can provide stronger long-term protection against local economic risks.

A strong retirement plan isn’t just about following conventional wisdom—it’s about making informed, strategic decisions that align with your long-term financial goals. The world is full of opportunities—seize them wisely.

Further Reading: The Definitive Retirement Planning Guide for South Africans in 2025

Disclaimer: Performance figures are annualised to 25 August 2025, sourced from ASISA categories in our dataset, and may change; past performance is not a reliable guide to future returns. This article is general information, not advice – fund classes, fees, and tax/regulatory considerations may differ by investor – please speak to a qualified adviser before making decisions.

Carl-Peter Lehmann

Carl-Peter is a Certified Financial Planner (CFP®) and a Director at Henceforward, specializing in wealth management and offshore investments. With over 20 years of experience in the financial services industry, including time spent abroad, he provides expert insights on retirement planning, investment strategy, and financial independence. Passionate about helping South Africans build globally diversified and tax-efficient portfolios, Carl-Peter is committed to delivering practical, independent advice that empowers investors to achieve long-term financial security.