The Ultimate Guide to Living Annuities in South Africa: Retirement Income, Risks & Best Strategies

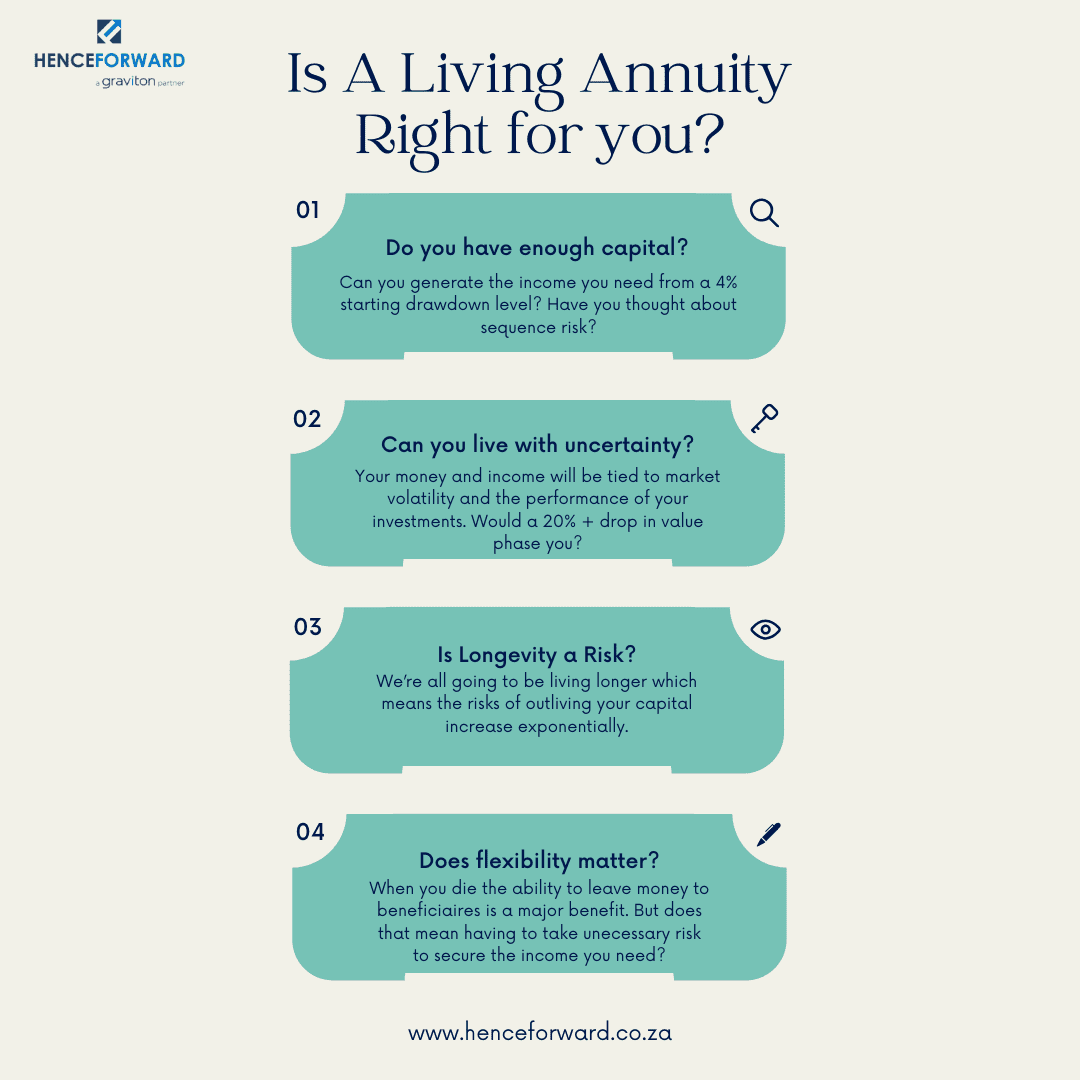

A living annuity offers retirees flexibility in managing their retirement income, but choosing the right strategy is crucial to ensure your savings last. From withdrawal rates and market risks to low-cost investment options, this guide unpacks the key factors to consider when structuring a sustainable living annuity. We explore the best performing funds, the risks of relying solely on balanced funds, and how to navigate fees, longevity risk, and portfolio construction for a secure retirement.