🟡 Gold’s Second Renaissance: Why Central Banks Are Turning Their Backs on the Dollar

Gold is glittering again as central banks diversify and investors rush in — but with prices going parabolic, we explain why it’s not the time to chase the rally.

Home » Archives for henceforward

Gold is glittering again as central banks diversify and investors rush in — but with prices going parabolic, we explain why it’s not the time to chase the rally.

How much is enough for retirement in South Africa? We break down real numbers, income scenarios, and why compounding and strategy matter for building a sustainable retirement.

Discover how ETFs can help South Africans build cost-effective, diversified portfolios with global reach.

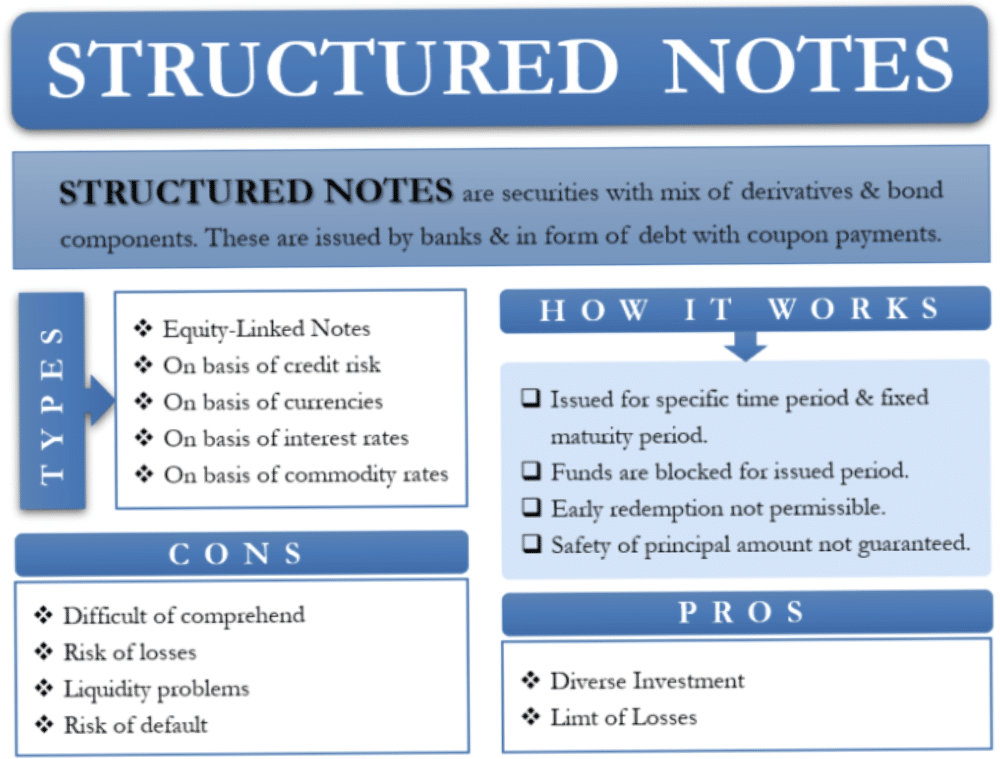

Structured notes have quietly moved from niche products to mainstream tools in South African wealth management. They appeal to investors who don’t want to be fully exposed to market swings, yet find the low returns of bonds or cash uninspiring. In many ways, they offer a middle ground: a blend of capital protection, enhanced yield, and tailored market exposure.

SA trusts can’t invest offshore via allowances, but may distribute cash to a named offshore trust – subject to SARS/SARB approval and 2024 tax changes.

For decades, preference shares have been used by companies, families, and investors as a bridge between debt and equity, offering steady income streams while enjoying favourable tax treatment. With the proposed amendments, however, much of the appeal of preference shares could disappear.

A candid interview with Long Beach’s David Hansford on running a top SA balanced fund—near Reg 28 limits, quality growth picks, and letting winners run.

In investing, it’s not what you buy—it’s how you behave once you’ve bought it. That’s the central lesson of The Art of Execution by Lee Freeman-Shor, a book that shows why even top fund managers often underperform despite brilliant ideas. The difference lies in execution: cutting losers quickly, letting winners run, and resisting the behavioural traps that derail most investors

For many South African investors, the journey to offshore diversification begins with prudence – convert rands to pounds or dollars and park the money safely in a UK or US bank account. It’s understandable. Cash feels secure. It preserves foreign currency exposure and is easy to access. But is it efficient?

In an era where financial advice is dispensed in 30-second TikToks and AI tools can build entire portfolios in seconds, it’s natural to ask: Is the human financial planner still relevant? At Henceforward, we believe the answer is a resounding yes – but the game has changed.

If you’re a South African investor, how you invest offshore matters as much as why you invest offshore. Done right, offshore investing can help you diversify currency, reduce taxes, simplify your estate, and grow your wealth with global access. This article explores offshore wrappers … a powerful but often misunderstood solution.

A detailed financial planning case study: how a young professional couple restructured their retirement, investments, and estate planning for long-term success — with guidance from Henceforward on a flat R40,000 annual fee.